Closing General Ledger at Year-End

General Ledger closing does not need to occur on the last day of your year or the first day of the new year. Usually, the G/L year-end procedures are not performed until weeks after the actual end of your business year.

When you are ready to close G/L for the year, use this job aid as a guide to the functions and procedures you need to complete. For detailed information, refer to online help. Open the General Ledger book, then the End-of-Period/End-of-Year Procedures book, and then the End-of-Year book.

1

Perform the monthly close

Complete the general ledger monthly close as you normally do, posting month-end adjustments in the General Journal Transactions (GGMU) window.

2

Print a trial balance and financial statements

Use the Print Trial Balance (RGTR) window to print a trial balance for all accounts for the entire year.

Use the Print Financial Statements (RGFS) window to print statements for each period.

The trial balance and statements provide your accounting advisor the information needed to determine adjusting entries for year-end.

3

Post year-end adjustments

After you have completed the normal general ledger monthly close, post all year-end adjustments (provided by your accounting advisor) in the General Journal Transactions (GGMU) window.

![]()

Do not make closing entries for expense and revenue accounts. Function GYEN does this automatically.

4

Print a trial balance and financial statements (again)

Use the Print Trial Balance (RGTR) window to print and spool a trial balance for all accounts for the entire year, one with detail and one without detail. If you do not have Spooler Archive, delete-protect the spooled report, and create a comment regarding the report's content.

Use the Print Financial Statements (RGFS) window to print and spool copies of statements for each period.

Use the trial balance and statements to verify that all adjustments for year-end are correct and to print copies of your final statements.

Closing entries for expense and revenue accounts do not have to be made yet. Function GYEN does this automatically by only carrying forward Balance Sheet account totals to the new year.

5

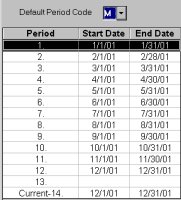

Check the Accounting Period Maintenance window (GRMU)

It is VERY IMPORTANT that you check and recheck the date in GRMU. These dates should reflect only the fiscal or calendar year that you are about to close.

-

Periods 1 through 12 should each display a month.

-

Period 13 should be blank.

-

Period 14, the Current Period, should be the same as period 12.

If GRMU is not set up this way, you must change it now.

-

If you are on 12-period cycle, at Default Period Code, select M.

-

In the Starting Date field of Period 1, enter the starting date of the first period in the year you are closing, and press Enter. Periods 1-12 change automatically.

-

In period 14, enter the same dates as period 12 and click Change.

![]()

If you operate your business on something other than 12 monthly periods, please check with the Eagle Advice Line for the appropriate settings prior to running GYEN.

6

Enter a one-sided entry in the General Journal Transactions window (GGMU)

Enter a one-sided entry to your Retained Earnings account in the General Journal Transactions window (GGMU). If you made a PROFIT then you will credit your retained earnings account. If there is a LOSS, then you will debit your retained earnings account. Posting

this entry places the Trial Balance for the year you are closing out of balance by your year-to-date Income or Loss. The Transaction Date will be the last day of the year you are closing. Because this is a one-sided entry, you will need to answer Yes to Post Out of Balance on the RGGG report.

![]()

If your system is set up to ONLY use T-Account entry in GGMU (option 9027 "Require use of the control number assigning 'T-Accounts' entry in GGMU" is set to Yes), you must change this option to NO to use the ADD button in GGMU to post the one- sided entry to close the year. When finished making the one-sided entry, you can change this option back to Yes.

7

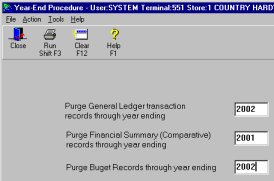

G/L Year-end Closing (GYEN)

GYEN does the following:

-

Zeros the revenue and expense accounts (profit and loss accounts).

-

Optionally clears all transactions from the General Ledger Transaction File, and creates a BBF (Balance Brought Forward) document for all Balance Sheet accounts.

-

Transfers the month-end balances of each account to the last year Comparative Fields window (accessible from the Go To menu in the Chart of Accounts window).

-

Rolls the date table forward in Accounting Period Maintenance to reflect the new year.

-

Updates the fields Earliest Allowed Transaction Date and the Last Year-End Procedure Run Dates in the G/L Control File (GCON).

GYEN does not require a quiet system. You can run this procedure while your store is open and POS is running.

When GYEN completes, go to Accounting Period Maintenance and change the date in Current Period 14 to the date of the period you are currently in.