(Returns Validation users only)

This topic describes the automatic display of the Returns Validation window in POS that occurs when merchandise is returned on a sale, credit memo, order, or special order.

![]()

You can also manually display the Returns Validation window in POS. After you type in an SKU in the posting area, press Menu (the dash on the keypad) and select N-Validate Return Items. Then select a document against which to apply the return.

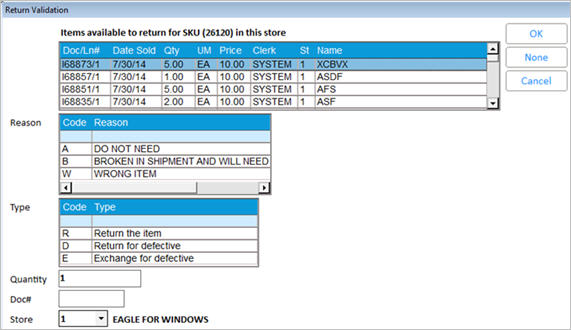

In POS, select the appropriate customer account. When you enter a credit item, the Return Validation dialog displays if there are any eligible invoices for that customer against which you can return the merchandise.

Multistore: If you are validating returns across stores (option ID# 8344 "Returns validation across stores allowed” is set to Yes), the system uses the lockin store’s setting for the option ”# of Month's activity to use in Returns Validation” (ID# 8307) to determine the sales activity to consider across ALL stores (unless you have changed the store on the header screen, in which case the system uses that store's setting).

If the Returns Validation dialog didn't display, skip to step 8 now. If the Returns Validation dialog did display, select the invoice to which you want to apply the return.

Note the following:

If you use Enhanced Forms and you print a barcode on transactions (option 7547 "Enhanced Form barcode prints for invoice documents" is set to Yes), simply scan the barcode to tell the system the prior purchase to which the return should be applied.

If you know the document number, you can <Tab> to the Doc# field and manually enter the document number (if you print barcodes on receipts, you can scan the barcode on the receipt or invoice instead of typing the number).

If multiple invoices are eligible for returning merchandise against, the system uses the option " Return Validation Posting Rule" to suggest an invoice by highlighting it in blue in the grid. This does not occur when creating a return for the default cash customer.

Lumber users: lumber items (L-type records) that are being returned must be posted with the same quantity unit of measure and pricing unit of measure as the invoice against which they are being validated.

If you want to bypass validation of the return, click None. Depending on your security, a manager override may be required to proceed.

If the document you're looking for isn't displayed in the grid, click More Trx until you locate the document (the More Trx button only displays if there are more eligible transactions on file).

If the document is still not found in the subsequent search, or you select No to abort the search, the message "Not a returnable prior purchase. <OK>" displays. In this case, you can press Cancel to abort the return, or press None to proceed with the return (security bit 768 or a manager's override is required).

In the Reason field (this field only displays if the option "Prompt for Return Reason" [ID #8414] is set to Yes, and the option "Add/Change user-defined return reason codes" [ID #8416] has been set up), select a return reason and click OK. The returned item posts in the POS grid, along with a comment line indicating the original document number, store number, and original document date. The cost the system uses for the return is based on the option "Post returns with current or original cost?” (ID# 8374).

In the Type field, select the type of return.

Click OK.

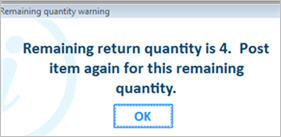

If the quantity being returned exceeds the quantity on the selected invoice, you'll receive a warning that you need to post the remaining quantity. Click OK.

The remaining return quantity displays in the POS posting area. Click Credit.

If there are other invoices against which you can return the items, select the next invoice to which you want to apply the remaining quantity. If that invoice also leaves a remaining returned quantity, the warning dialog displays again. Repeat this process until the entire returned quantity has been applied to prior purchases.

If there are no other invoices against which you can return the item(s), a warning displays. Press Cancel to abort the return, or you can proceed with the return if you have the security to do so or you obtain a manager's override when prompted.

If no invoices displayed in step 2, this means that either 1) the system couldn't find a record of this customer purchasing the item, or 2) there is no available quantity for this customer to return the item against. In either case, a warning displays; click Cancel to abort the return, or you can proceed with the return if you have the security to do so or if you obtain a manager's override when prompted.

![]()

On validated returns, if the tax code on the original sale (either header tax code, or line item tax code) is different from the header tax code on the return transaction, then the original tax code displays at the end of the "Original" descriptor. For example, “Orig: F44642/1 01/01/11 TX:A11” tells the clerk that the return of this item has been taxed using tax code A11.