The one cent (penny) will remain the basic unit in Canadian currency, however, Canadian pennies will no longer be minted or distributed to financial institutions.

Point of Sale (POS) will round the transaction total to the nearest 0 or 5 and will only do this on cash transactions requiring change (with cents) to be returned.

Cash transaction totals ending in 3, 4, 6, or 7 will round to the nearest 5.

Totals ending in 8, 9, 1 or 2 will round to the nearest 0.

Set up two non-merchandise, non-taxable SKUs in the system: one to round up, and the other to round down.

In the Options Configuration window, set up options 9954, 9955, 9956, and 9960. These options allow the system to auto- post (behind the scenes) the appropriate SKU to round up or down. In the examples below, will we use SKU 963 to round up and SKU 964 to round down.

If desired, use option 9958 “Presentation of 'Penny Rounding' amount on receipt/invoice” to select how the penny round up/round down amount is presented on receipts and invoices. D = the penny rounding SKU appears on the receipt/invoice as a detail line (this is the default setting). T = the penny rounding amount is shown as an adjustment to the Total.

Note: Use of this option requires that you set option 8971 "Use POS Adders in Order Entry" to A or M. If you don't already use POS Adders, then set this option to M. In addition, for invoices you must use an Enhanced Form with a format name that ends with "Adders."

Scan and post items in a transaction.

Click Total. The Totals screen displays and posts the tax and totals the transaction.

Enter the cash amount from the customer.

If the customer gives the clerk exact change (for an odd amount) including pennies, the transaction is completed.

If the customer gives the clerk an amount that would require change (with pennies) the system will auto post the appropriate SKU (round up/down) and will display the change to be returned to the customer.

If the transaction is anything other than cash, there are no changes in how transactions are completed.

A $1.80 coffee would be $1.89 with 5% GST Tax. If the customer pays with cash requiring change back, the final total is rounded up 1 cent (using the example of SKU 964 which auto posts) for a final payment of $1.90. If the customer chooses to pay with exact change, by check, credit or debit card, no rounding is applied and the final payment is $1.89.

A $1.50 coffee and a $2.80 sandwich in Ontario would cost $4.86 including $0.56 HST Tax (13%). If the customer pays with cash requiring change back, the final total is rounded down 1 cent (using example of SKU 963 which auto posts) for a total of $4.85. If the customer chooses to pay with exact change, by check, credit or debit card, no rounding is applied and the final payment is $4.86.

If the amount entered in the Cash field at POS has 1, 2, 6, or 7 cents, then rounding down is needed and the SKU in Option 9955.

If the amount entered in the Cash field at POS has 3, 4, 8, or 9 cents, then rounding up is needed and the SKU in Option 9956.

Example: Refund Total = 164.38. Enter 164.40 in cash and the system will automatically post SKU in Option 9956 for 0.02.

If the amount entered in the Deposit Amount field (manually or by system with auto calculation) is 100% (deposit amount = balance due), ends in pennies, and the pennies entered do not match the balance due, the system will automatically post the round-up or round-down sku as appropriate.

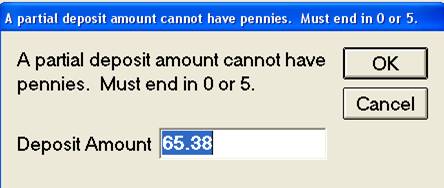

If the amount entered in the Deposit Amount field (manually or by system with auto calculation) is NOT 100% (deposit amount does not equal balance due), ends in pennies, and the pennies aren't 0 or 5, the system will display the following message. Make the necessary adjustments and click OK.