Using CPP to Calculate Custom List Prices

You can use the Category Pricing Plan (CPP)

window to compute a specific list price for a customer or group of customers

who share a pricing plan. This List Price is simply a calculated price

that prints on the customer's invoice so they can see what the Suggested

Price is for this item. The calculated List Price has no effect on the

selling price in POS.

The calculated List Price works in conjunction

with the option " Suggested

Price to Print"Suggested

Price to Print" is a POS option in Options Configuration, and determines

which price prints in the blank column of the invoice.

L = The system labels the column "SUGG PRICE" and prints the

list price if it is higher than the customer's price. If list is lower,

the customer's price prints in the SUGG PRICE column.

M = The system labels the column "SUGG PRICE" and prints the

retail price if it is higher than the customer's price. If retail is the

same or lower, the column is left blank.

P = This option is a combination of Options L and M. The system labels

the column "SUGG PRICE." If the item has a list price in the

Inventory Maintenance window, the rules for Option L are used. The list

price prints if it is higher than the customer's price. If the list price

is lower, the customer's price prints.

If the item does not have a list price, the rules for Option M are used.

The retail price prints if it is higher than the customer's price. If

the retail price is the same or lower, the column is left blank.

R = The system labels the column "SUGG PRICE" and prints the

retail price, if it is higher than the customer's price. If retail is

lower, the customer's price prints in the SUGG PRICE column.

If you leave this field blank, the system leaves the column on the invoice

blank. " (ID# 140) in Options Configuration.

The calculated List Price only prints if it’s higher than the customer’s

price.

To set up Custom List Prices, first select

the price the system should use to calculate the list price; your choices

are Price Matrix 1, 2, 3, 4, or 5; Replacement

Cost; Retail Price, or List Price (from Inventory Maintenance). Next,

you indicate if you want the selected price to be marked up, marked down,

calculated by gross profit, or used as is (no calculation). The calculated

list price is then used by POS as the list price to display on the customers'

invoices. Use the procedure below to set up CPP List Price Calculation.

- From the Customer

Maintenance window, click Go To. Click Category Pricing Plans.

- From the Category

Pricing Plans window, do one of the following

- If you are calculating list prices for an existing

plan, in the Plan box, use the drop-down list to select the plan for

which you want to add custom list prices, and click Display.

- If you are setting up a new plan, type a plan

name (up to 10 characters). Then continue to set up the plan by selecting

your options from the lists for Best Price, Trade Discountable, Terms,

and Incl CPP < Non-Disc/Promo Prc. For a definition of each field,

click here.

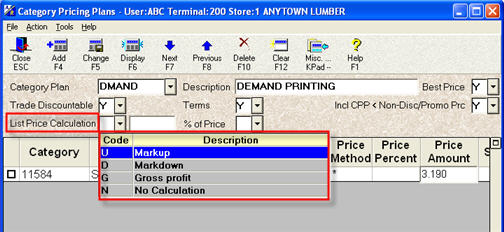

- In the List Price Calculation field, select

a calculation method from the drop-down list. For example, if you

want the list price to be the Retail price marked up by 5%, select

U (Markup) in this field.

- In the % field, enter the percentage you want

the system to use when calculating list price. To continue the same

example (Retail marked up by 5%), you would enter 5 in this field.

- In the "of Price" field, select the

price you want to use to calculate the list price. To continue the

same example (Retail marked up by 5%), you would select Retail Price

in this field.

- If you are changing an existing plan, click

Change, then close the CPP window. If you are adding a new plan, Click

the Category column, and click Add to begin adding categories to the

plan. For more information on adding a new plan, see the topic "Using Category Pricing Plans."

- Assign the plan you just modified or created

to the appropriate customer(s) in the Customer Maintenance window,

in the Category Plan field.

The table below illustrates

list price calculations for an item whose current Matrix Price 1 is $10.00.

List Price Calculation |

List

Price Percentage |

List

Price Field |

New

List Price |

U— Markup |

120% |

Price Matrix 1 |

12.00 |

D— Markdown |

5% |

Price Matrix 1 |

9.50 |

G— Gross Profit |

20% |

Sell Price |

18.75 (15.00 / (1-.20)) |

N— No Charge |

|

|

Blank |