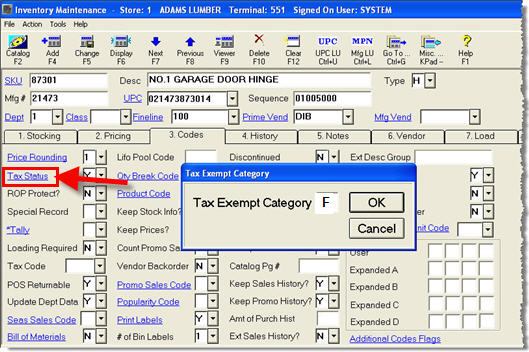

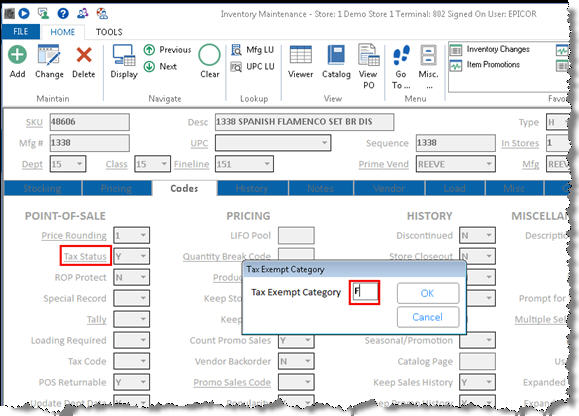

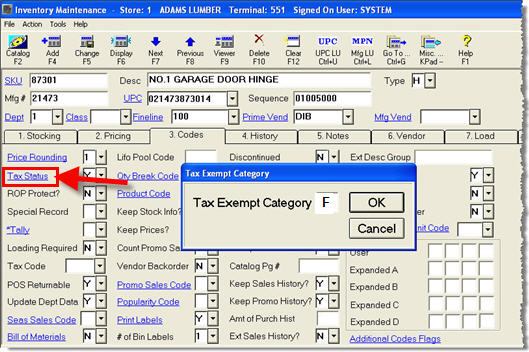

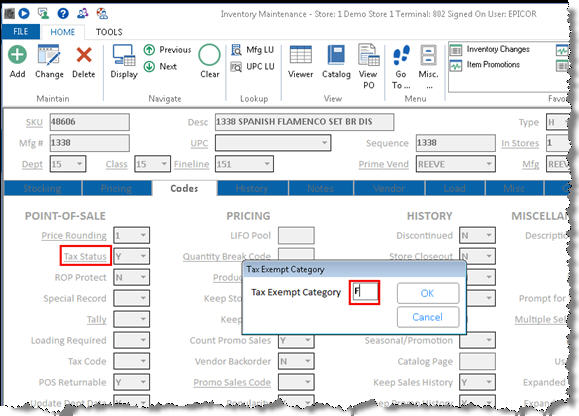

This field is on the Codes tab of Inventory Maintenance. Click the Tax Status hyperlink to access this field.

This field is intended to be used as a Category Type in a Tax Override Plan to identify items for which the customer is tax exempt based on the POS lockin store. This feature helps you sell items which are taxable items, but for some customers (i.e., farmers), they are tax exempt. To set up this feature, do the following:

Set this field to a single-digit value that makes sense. You can use a number or letter, such as F for farmer, in the stores where that item is tax exempt for a farmer, and leaving it blank in the stores it is not tax exempt for farmers. Note that the item’s tax exemption eligibility is determined by the state in which it is purchased. For example, if a farmer purchases from locations which are in different states, an item may be tax exempt in a store located in one state, but not exempt in a store located in another state.

Create a Tax Override Plan using a 0% tax code, and selecting type R-Tax Exempt Category. When asked for the Tax Exempt Category, type the code you entered in Inventory Maintenance in step 1.

Assign the Tax Override Plan in Customer Maintenance to each farmer.

Example of a Tax Exempt Category