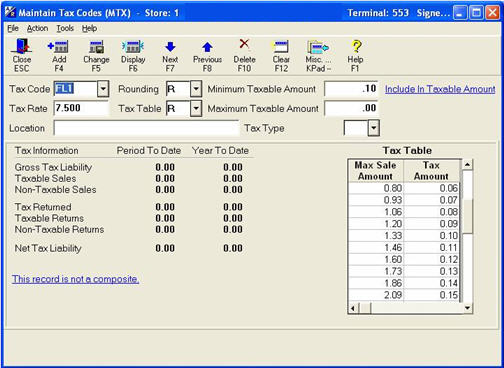

Maximum Sale Amount.

This field in the Maintain Tax Codes (MTX) window is the amount up to which you charge the corresponding tax amount. You can enter up to four numbers plus a decimal in this field (e.g., 12.34). This field works with the Tax Amount field to determine the sales tax amount.

For example: The first line of the Max Sale Amount is .15, and the Tax Amount is .01. This means that on sales up to $.15, the system assesses a $.01 sales tax.

Note: the system also takes into account the Minimum Taxable Amount field. Thus, if the Minimum Taxable Amount is set to 0.10, then sales amounts between 0.01 – 0.09 won't have any sales tax assessed on the transaction; only transactions 0.10 and higher will get taxed.

The tax table type (ceiling or repeating) determines how the system calculates sales tax on amounts over the last line of the Max Sale Amount.

For ceiling tables, the system uses the tax table on sales up to the last line of the Max Sale Amount field. It uses the Tax Rate to calculate the sales tax on sales that exceed the last line of the Max Sale Amount.

For example: The tax rate on Screen 1 is 7%. The last line of the Max Sale Amount is 1.15, and the corresponding Tax Amount is .08. The sales amount is $2.50. The system charges 7% sales tax because the sales amount ($2.50) is greater than the last line of the Max Sale Amount (1.15).

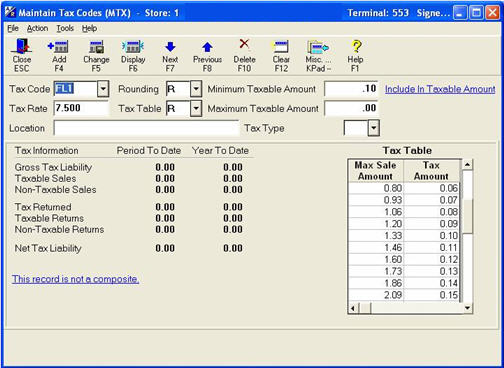

For repeating tables, the system uses the tax table on sales up to the last line of the Max Sale Amount field. The system calculates the sales tax on sales that exceed the last line of the Max Sale Amount as follows:

Using this example:

The sale amount is $23.99. To determine the sales tax, the system does the following:

Divide the sale amount by the last line’s Max Sale Amount (23.99 divided by 2.09 = 11.478).

Multiply the resulting whole number by the last line's Tax Amount (11 x .15 = $1.65).

Multiply the same resulting whole number by the last line’s Max Sale Amount (11 * 2.09 = 22.99).

Subtract the result in step 3 from the original sale amount (23.99 – 22.99 = $1.00)

Use the tax table to determine the sales tax on this remaining amount ($1.00 is .08).

Add the sales tax from step 2 and step 5 together (1.65 + .08 = $1.73).