Entering Debit or Credit Memos

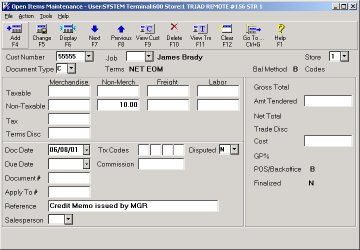

Field definitions for entering Debit or Credit Memos:

Document Type

There are three possible document types that can be entered in Open Item Maintenance (MOI). They are:

Invoice— Normally created at POS, when a sale is charged to a customer account. Invoices can also be added in Open Item Maintenance (MOI).

Credit— Normally created at POS, when a credit memo is charged to a customer account. Credits can also be added in Open Item Maintenance (MOI).

Adjustment— Created in Open Item Maintenance (MOI) only. An adjustment can be for a positive or negative amount (debit or credit).

Notes:

Open Item Maintenance is normally used to enter beginning balances. After that, customer transactions (invoices and credits) are normally entered through POS.

Transactions entered through Open Item Maintenance will affect Accounts Receivable and Sales, but do not update the Inventory files. If you pass-off to General Ledger, the default Sales account (as specified in MCT) will be updated.

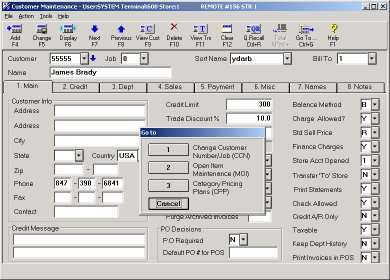

1

Access Open Item Maintenance

From the Eagle Browser, click Accounts Receivable, then click Customer Maintenance.

Enter the customer number.

Click Go To.

Select Open Item Maintenance.