Tax Free Holiday: Setup

Set Up Option 9700

In Options Configuration, set option 9700 "Tax Free Holiday feature

available on System" to Yes. In the Options Configuration window,

click ID, enter 9700, and press Enter. Set the Current Value field to

Yes, and click Change.

Set Up Returns Validation

If you are not already using Returns Validation, you must set it up.

This ensures that any returns that occur after the tax free holiday is

over get returned at the correct, original tax code and rate. For complete

setup instructions, click here.

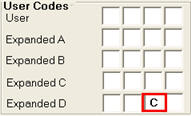

Set Up User Codes for Tax Free Holiday

You can have up to nine categories that uniquely identify an item or

group of items that are eligible for the Tax Free Holiday.

Decide what your categories

are, and which User Code value and User Code position you will use

to represent each category.

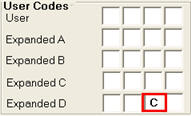

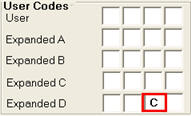

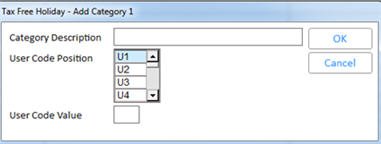

In Inventory Maintenance

on the Codes tab, for each item in a category, set the User Code to

the designated position/value. For example, you may decide that clothing

items will have a value of C in the third position of Expanded Codes

D, as shown below.

Note: You can use Item

Code Update (RICU) or a Keyboard

Macro to quickly change User Codes.

Set Up the Tax Free Holiday

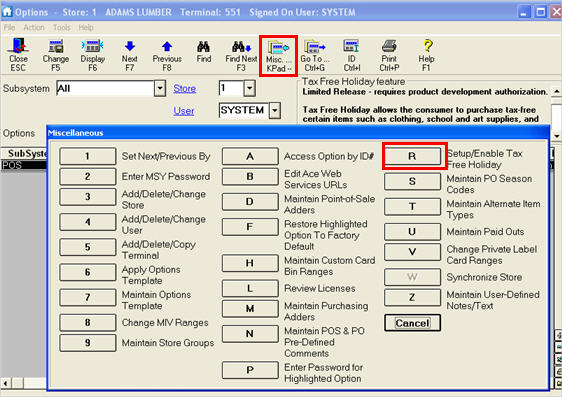

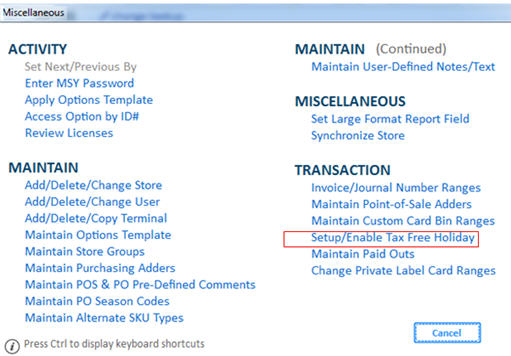

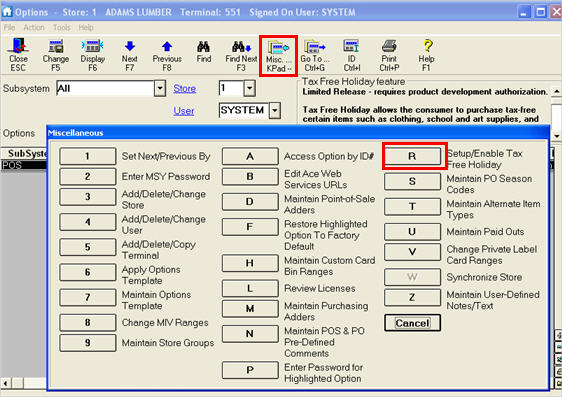

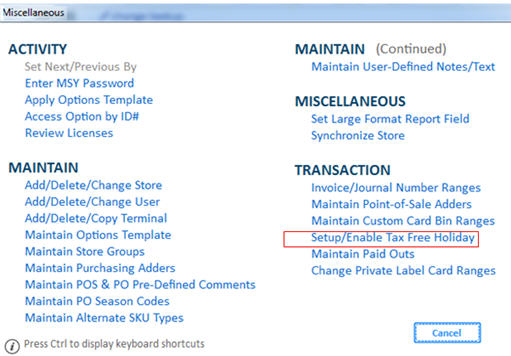

In Options Configuration,

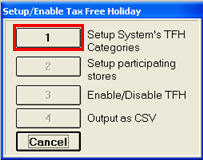

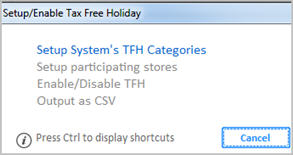

click Misc and select Set up/Enable Tax Free Holiday.

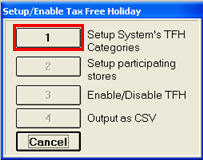

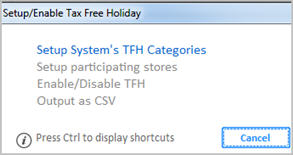

In the next dialog, select

1 – Set up System’s TFH Categories.

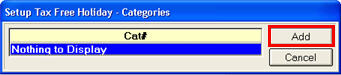

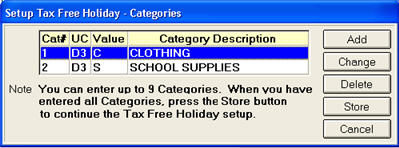

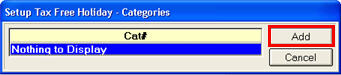

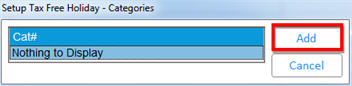

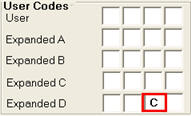

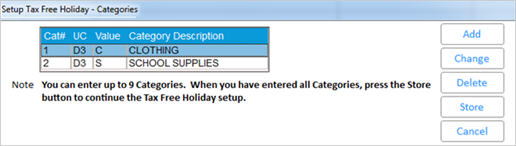

In the Categories dialog,

click Add.

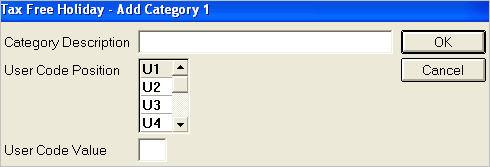

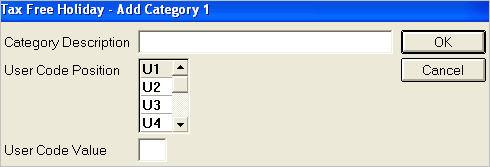

In the Add Category dialog

that displays, fill in the fields. When finished, click OK.

Click any of the following

for more information about that field.

Category

DescriptionEnter

up to 32 characters to identify the item or group of items. The Category

Description should be a name or phrase that identifies the item or

group of items with the assigned user code and user code value. For

example, if the group of items you wish to include in the Tax Free

Holiday is clothing, the Category Description would be "Clothing."

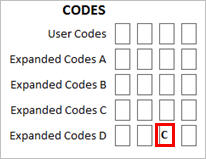

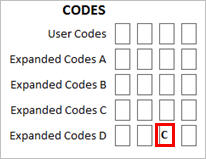

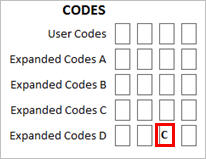

User

Code PositionEnter

the user code position that the item or group of items will be assigned

to in Inventory Maintenance.

The user code position, and user code value, should match the items'

user code and user code value that are identified under this category.

For example, all items that would be classified as ‘Clothing’ for

the Tax Free Holiday would have a user code value of C in the 3rd

position of the Expanded D user codes in the Codes tab of Inventory

Maintenance:

User

Code ValueEnter

a one-character value that will be entered in the designated User

Code Position, to which the item or group of items will be assigned

in Inventory Maintenance.

Add

more categories if desired. Note: You can have up to nine categories.

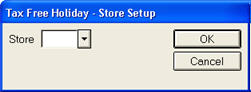

Press

Store to begin the store and category setup.

Select the store number,

store group, or "All" stores participating in this category

of the Tax Free Holiday. Then click OK.

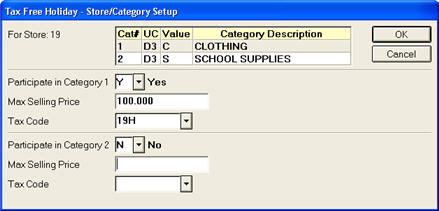

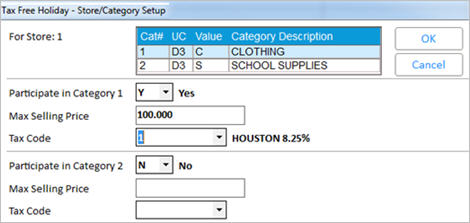

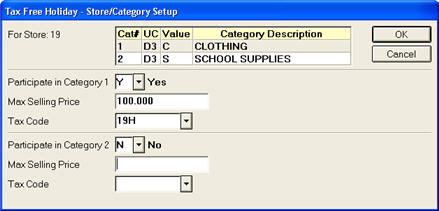

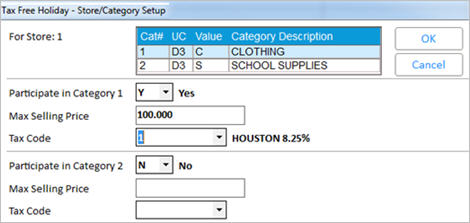

A dialog displays, showing

each Store/Category Setup. Fill in the fields.

Click any of the following

for more information about that field.

Participate

in Category XWhere

X is the category number, this field determines whether a specific

category in a specific store participates in the Tax Free Holiday

(TFH). Set this field to Yes for each of the participating categories.

Leave the categories that will not be participating to N-No.

Note: In order to include a store or store group in the Tax Free Holiday,

there must be at least one category participating for that store.

Max

Selling PriceThe

Maximum Selling Price for an item sold within a specific category

and store to post as nontaxable. For each enabled category for a given

store, you can establish a maximum selling unit price.

If the retail price is equal to or less than the Max Selling Price,

the item will post as "tax free’" in Point of Sale. Option

9703 "Tax Free Holiday – meaning of the Max Selling Price"

determines what happens when the price is over the Max Selling Price.

If it is set to 'E', it will tax on any amount over the threshold.

If set to 'F', it will be fully taxable.

Tax

CodeEnter

the specific Tax Code for the participating category. Each category

participating can have a different Tax Code. The Tax Code should be

set up with 0.00% Tax Rate in Maintain Tax Codes (MTX) in order for

the item to post as non-taxable, although you can use a Tax Code that

has a tax rate, depending on the state/local Tax Free Holiday guidelines.

Once you have set up all

of the categories that are participating in the given store’s Tax

Free Holiday, click OK.

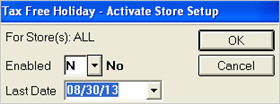

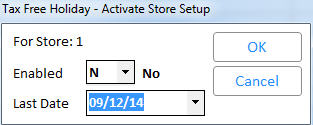

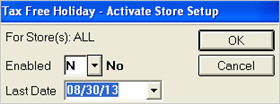

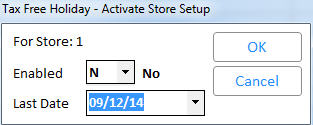

In the Activate Store Setup

dialog that displays, fill in the fields.

Click either of the following

for more information about that field.

EnabledThis field determines if the Tax Free Holiday (TFH)

is active. When set to Yes, the item(s) that meet the store and category

criteria post as nontaxable. When set to No, the item(s) that meet

the store and category criteria post under normal conditions using

the store and/or customer setup.

Typically you would set up the TFH ahead of

time, setting the Enabled field to N. Then, when the TFH is due to

start, go to Options Configuration, click Misc, and select option

R. Then select 3-Enable/Disable TFH. Enter the Store/Store Group,

click OK, and change the Enabled field to Y. Be sure to enable all

relevant Stores/Store Groups.

Last

DateThis

field identifies the last day of the Tax Free Holiday (TFH). The TFH

runs through the date specified in this field. Each store participating

in a given TFH can establish a unique End Date for it. The following

day after the Last Date, items go back to posting normally.

To make additions, changes,

or deletions to the categories and selected stores, in Options Configuration

click Misc, and select R – Setup/Enable Tax Free Holiday. Then select

the appropriate button.

1 – Set

up System’s TFH CategoriesThis takes you to the Setup Tax Free Holiday –

Categories prompt, where you can Add more categories if all nine have

not been used yet, and to Change and Delete existing categories.

Categories are master data, which means they

can be used across all stores. Once the categories have been set up,

you can add, modify or delete them by selecting this option. If a

category is deleted, the category is automatically removed from the

store setup as well.

2 – Set

up participating storesThis option allows you to select a new store that

will participate in the Tax Free Holiday (TFH) or to change an existing

store that has already been set up.

All settings within this option are store

specific, which means that the setup only applies to the store or

store groups selected. You select a store, store group, or all stores,

and configure each category to participate in the TFH.

3 – Enable/Disable

TFHThis

option allows you to enable or disable the Tax Free Holiday (TFH)

and to modify the Last Date the TFH

is to be active.

4 – Output

as CSVThis

option allows you to view the Tax Free Holiday (TFH) options as a

csv file by System or by Store.

When selecting this option, you are prompted

to select to view either System settings or Store settings.

If you select System settings, all of the nine categories along with

their respective user code position and user code value display in

a CSV (Excel or Notepad) output.

If you select Store settings, you are prompted to select the

store or store group, so that the store or store group's store-specific

options display in a CSV file (Excel or Notepad). A store's/store

group's settings include all categories that participate or do not

participate, the Max Selling Price and Tax Code for each of the categories,

whether the TFH is active or not, and the last day of the TFH.

On the day of the Tax Free

Holiday (TFH), be sure that your TFH categories are EnabledIn Options Configuration, click Misc and select

option R, then select 3-Enable/Disable TFH. Enter the Store/Store

Group, click OK, and change the Enabled field to Y. Be sure to enable

all relevant Stores/Store Groups. . Note:

The TFH automatically ends the day after the date entered in the Last

Date field.

Setting

Max Sell Price

The Tax Free Holiday

Feature supports states where clothing/footwear is tax exempt on a portion

of the selling price and taxable on the amount over that. Currently there are 2 states with this type

of exemption:

Massachusetts where the cap is $175, an item

whose selling price is more than $175 is taxed but only on the amount

over $175

Rhode Island where the cap is $250, an item

whose selling price is more than $250 is taxed but only on the amount

over $250

Normally

the Tax Free Holiday feature allows you to setup a category with

a Max Selling Price where any item in that category which has a selling

price over this amount will be excluded from the tax exemption, so the

item will be fully taxable.

Massachusetts and Rhode Island customers can now set the new ‘by Store’

E4W Option 9703 “Tax Free Holiday - meaning of the Max Selling Price”

to E to have the Max Selling Price mean that if an item in that category

has a selling price more than the Max Selling Price the tax will be calculated

on the amount of the selling price over the Max Selling Price using the

customer's normal tax code and rate.

For example:

If the Max Sell Price setup for a category is $100.00 and an item that

qualifies in the category has a sell price of $150.00, the amount up to

$100.00 is nontaxable and $50.00 is taxable under the transaction’s tax

code. If the item that qualifies in the category has a selling price below

$100.00, the item will be non-taxable under the tax code assigned to that

category in TFH.

Setup:

Set

Option 9700 "Tax Free Holiday feature available on System"

to Yes

Set

Option 9703 "Tax Free Holiday - meaning of the Max Selling Price"

= E - Excess over max Selling Price is taxable (kept by store)

In

Options Configuration use Misc Menu “Setup/Enable Tax Free Holiday”

to add a category for the clothing and footwear this exemption applies

to. Entering

the user code position and value you’ll use to identify these items,

and then enter the stores that will participate, and then enter the

max tax exempt amount in the Max Selling Price and the 0.00% tax code

to use for items whose selling price is below the Max Selling Price.

Assign

clothing and footwear the user code value you specified in the category

and then enable the Tax Free Holiday.

How

to Use:

Under

Max Sell Price

Start transaction

in POS.

Post item assigned to the category where the

sell price is under the Max Sell Price of the category.(Item should

post as non-taxable)

Complete transaction, total and tender

Amount for item should record as non-taxable

under the tax code setup for the category in the TFH

Over

Max Sell Price

Start transaction

in POS.

Post item assigned to the category where the

sell price is equal to or over the Max Sell Price of the category.(Item

should post as taxable)

Complete transaction, total and tender

Amount up to the Max Sell Price should record

as non-taxable, the excess above the Max Sell Price should record

as taxable both on the transaction’s tax code (not the TFH tax code)