You can assess multiple Taxes on a single transaction if you are in the United States. For example, your state may mandate a lumber tax, such as in California. Use the following procedure to set up a composite (or "master") tax code, which is made up of multiple tax codes (the components). In Accounts Receivable and POS, the Eagle system recognizes composite tax codes, and calculates tax according to the rules of its components.

To use this procedure, an Epicor representative must set option 1125 to B--both composite and line-item tax.

From the Eagle Browser Launch bar, type MTX, and press Enter. The Maintain Tax Codes window displays.

Add the Component tax code by doing the following:

In the Tax Code field, enter a short identifier (up to three digits) for this tax code.

In the Tax Rate field, enter the tax rate.

In the Location field, enter "Lumber Tax" or the Sales Tax authority, “City, State or County” or something similar, and the Percent if desired.

Press Add.

Repeat this process until all “Components” are added that will make up the “Composite” Tax code.

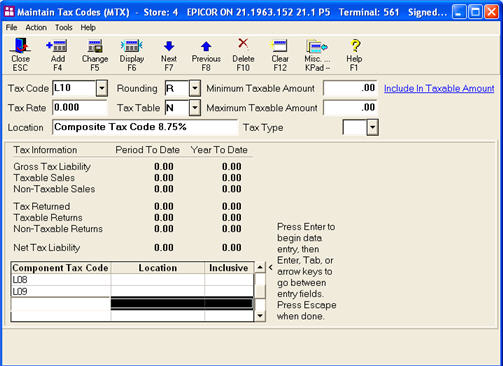

Add the Composite tax code by doing the following:

In the Tax Code field, enter a short identifier (up to three digits) for this tax code.

Leave the Tax Rate field blank.

In the Location field, enter a description to describe the tax code.

Press Add.

Tie your "Component" tax codes to your "Composite" tax code, as follows:

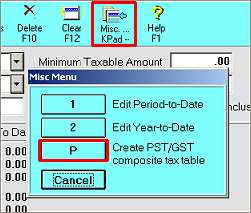

Click Misc, and then click "Create composite tax table."

Press Enter so you can begin entering component tax codes.

Enter the component tax codes in the left column. You can enter up to six component tax codes.

Follow the steps listed to the right of the grid, and when you have entered all components, press Escape to exit the Component section.

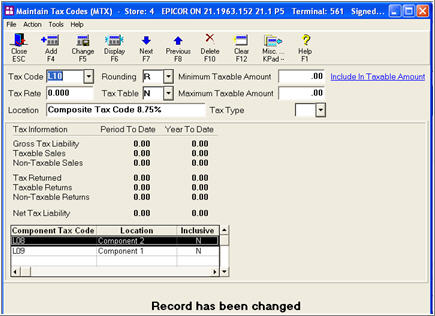

Press Change to add the Components to the Composite Tax code.

Assign a composite tax code as needed by doing the following:

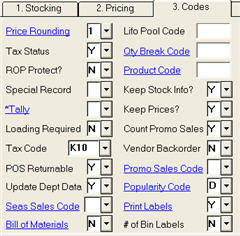

If you need to assign a composite tax code at the line-item level, use the Tax Code field of Inventory Maintenance. Make sure that the Tax Status field is set to Y. Enter or select the composite Tax Code from the drop-down list, and Press Change.

You can assign a composite tax code by store using Item Code Update (RICU) on the Codes 2 page. Use extreme caution, as this feature can cause unexpected negative results if a mistake is made. Epicor recommends you work with an Eagle Advice Line agent to assure RICU is run correctly.

Tax Code is a store-specific field; therefore, you may have to add an additional Master/Composite tax code for additional store locations.