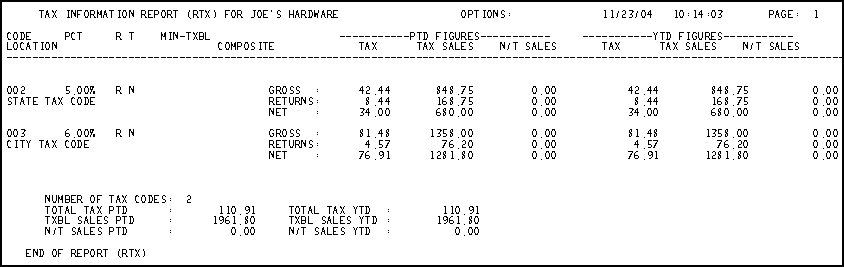

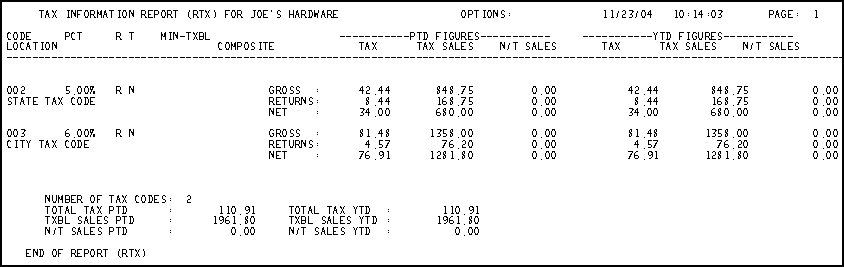

This topic provides an example of the Tax Information Report (RTX) and definitions of the fields on the report. For more information about RTX and procedure steps for running the report, click here to go to the online help topic. This report is available from both the Eagle Browser and Network Access.

The following is an example of the report. Click a field in the report to take you to the field definition.

The following is a list in alphabetical order of the fields on the RTX report.

Code— The tax code from Maintain Tax Codes (MTX).

Composite— For Canadian users, this is the composite tax code information.

Location— The description of the location, from the Location field in Maintain Tax Codes (MTX).

Min - Txbl— The minimum sale amount that is subject to sales tax. For a sale amount less than this, sales tax is not calculated.

Number of Tax Codes— A count of the tax codes included on this report.

Options— The option codes used when running this report. For a definition of each Option, click here to go to the help topic.

PCT— Percent. This is the percentage of tax.

PTD Figures— The Daily Journal Report (RDJ) run with Option F (Finalize) updates the PTD figures and YTD figures. The PTD figures are cleared each time the RTX report is run with Option P (Period-end Update).

Tax - Gross— Sales tax dollars from Invoice and Adjustment transactions (Type I and Type A transactions).

Tax - Returns— Sales tax dollars from Credit transactions (Type C transactions).

Tax - Net— Sales tax dollars calculated by subtracting Returns from Gross.

Tax Sales - Gross— The sum of the amounts for Taxable Merchandise, Taxable Labor, Taxable Non-Merchandise, and Taxable Freight on Invoice and Adjustment transactions (Type I and Type A transactions).

Tax Sales - Returns— The sum of the amounts for Taxable Merchandise, Taxable Labor, Taxable Non-Merchandise, and Taxable Freight on Credit transactions (Type C transactions).

Tax Sales - Net— Taxable sales dollars calculated by subtracting Returns from Gross.

N/T Sales - Gross— The sum of the amounts for Non-Taxable Merchandise, Non-Taxable Labor, Non-Taxable Non-Merchandise, and Non-Taxable Freight on Invoice and Adjustment transactions (Type I and Type A transactions).

N/T Sales - Returns— The sum of the amounts for Non-Taxable Merchandise, Non-Taxable Labor, Non-Taxable Non-Merchandise, and Non-Taxable Freight on Credit transactions (Type C transactions).

N/T Sales - Net— Non-Taxable sales dollars calculated by subtracting Returns from Gross.

R T— R is the Rounding flag. T indicates use of a tax table. As per the tax code in Tax Code Maintenance (MTX).

Totals— The totals for the tax codes included on this RTX report.

Total Tax PTD— The sum of the amounts in the PTD-Tax-Net fields.

TXBL Sales PTD— The sum of the amounts in the PTD-Tax Sales-Net fields.

N/T Sales PTD— The sum of the amounts in the PTD-N/T Sales-Net fields.

Total Tax YTD— The sum of the amounts in the YTD-Tax-Net fields.

TXBL Sales YTD— The sum of the amounts in the YTD-Tax Sales-Net fields.

N/T Sales YTD— The sum of the amounts in the YTD-N/T Sales-Net fields.

YTD Figures— The Daily Journal Report (RDJ) run with Option F (Finalize) updates the PTD figures and YTD figures. The PTD and YTD figures are cleared each time the RTX report is run with Option Y (Year-end Update).

Tax - Gross— Sales tax dollars from Invoice and Adjustment transactions (Type I and Type A transactions).

Tax - Returns— Sales tax dollars from Credit transactions (Type C transactions).

Tax - Net— Sales tax dollars calculated by subtracting Returns from Gross.

Tax Sales - Gross— The sum of the amounts for Taxable Merchandise, Taxable Labor, Taxable Non-Merchandise, and Taxable Freight on Invoice and Adjustment transactions (Type I and Type A transactions).

Tax Sales - Returns— The sum of the amounts for Taxable Merchandise, Taxable Labor, Taxable Non-Merchandise, and Taxable Freight on Credit transactions (Type C transactions).

Tax Sales - Net— Taxable sales dollars calculated by subtracting Returns from Gross.

N/T Sales - Gross— The sum of the amounts for Non-Taxable Merchandise, Non-Taxable Labor, Non-Taxable Non-Merchandise, and Non-Taxable Freight on Invoice and Adjustment transactions (Type I and Type A transactions).

N/T Sales - Returns— The sum of the amounts for Non-Taxable Merchandise, Non-Taxable Labor, Non-Taxable Non-Merchandise, and Non-Taxable Freight on Credit transactions (Type C transactions).

N/T Sales - Net— Non-Taxable sales dollars calculated by subtracting Returns from Gross.