Writing Off Bad Debts

Writing Off Bad Debts

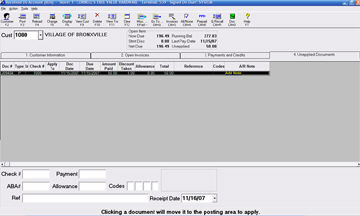

From the Received On Account window, you can enter a payment transaction for the purpose of writing off a bad debt. Use the Allowance field to enter the amount you are writing off as a bad debt.

1.

Accessing Received on Account (ROA)

-

From the Eagle Browser, click Accounts Receivable Menu.

-

From the Accounts Receivable menu, click Received on Account.

-

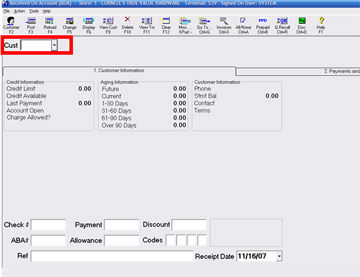

In the Cust box:

-

If you know the customer number, type the number and press ENTER.

-

If you know the customer name, type all or part of the customer name. From the list that displays, click the correct customer.

-

If you know the phone number, type the phone number (with or without the area code). From the list that displays, click the correct customer.

-

If you have set up Alternate Customer IDs, type = (equal sign) in the Customer box, then type an Alternate ID (i.e. driver's license number, street address, etc.).

2.

Determine the type of account

Take one of the following actions:

-

If this is a balance forward account, type in the Bad Debt amount you are writing off amount in the Allowance field, continue to section 4 steps 3 and 4.

-

If this is an open item account and the Unapplied Documents tab displays, you must first apply any unapplied documents before writing off the bad debt. Continue to section 3.

3.

Applying an unapplied payment

-

Click the Unapplied Documents tab.

-

Click the unapplied document that you want to apply. The Open Invoices tab automatically displays and the unapplied payment information is filled in.

-

Fill in any other payment fields on the screen. At a minimum, you must fill in Check # and Payment.

-

Press TAB or use the mouse to click the field you want to enter.

-

Select the invoices that this check applies to. To select an invoice, check the box on the left, next to the Store field.

-

Click Post or press ENTER to post the payment.

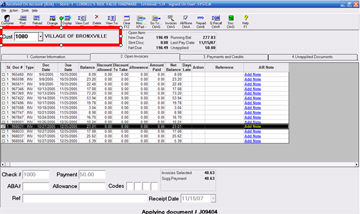

4.

Select and apply the bad debt

-

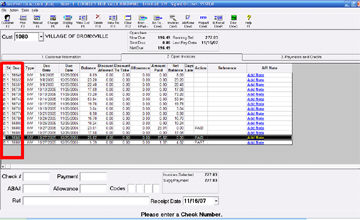

Select the invoices that make up the bad debt. To select an invoice, click the box on the left, next to the Store field.

-

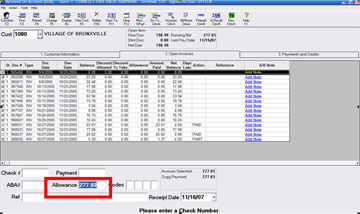

Type the Bad Debt amount you are writing off in the Allowance field.

-

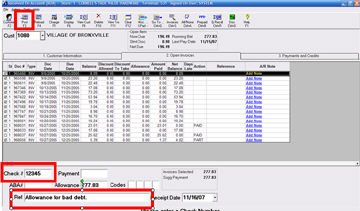

Fill in any number you want in the check number field (this is a required field).

Note: Fill in the reference (Ref) field to remind you that this is an allowance for a bad debt.

-

Click Post.

Note: If you are using ROA Multiple Allowances (option ID: 860) a window displays allowing you to select from the different allowances you have set up. Do not select an option; instead, click OK, and the allowance posts to the Write Offs (bad debt) GL account. See the Job Aid "ROA Multiple Allowances" for more information.