Adjusting Customer Accounts without Affecting Sales

This job aid describes how to adjust an accounts receivable balance without affecting taxable/non-taxable sales. The account balance can be a credit or debit balance.

1

Adjusting a credit balance

-

From the Eagle Browser, click Applications, then click Accounts Receivable Menu.

-

From the list that displays, click Customer Maintenance.

-

Display the customer.

-

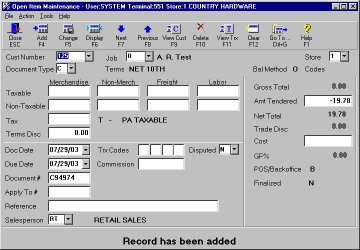

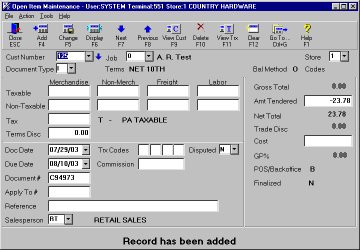

Click GoTo and Select Open Item Maintenance. Verify that the correct customer information displays.

-

From the Document Type pull-down list, select I - Invoice.

-

In the Amt Tendered box, type the amount of the adjustment, including the minus sign. For example, if the running balance is – 23.78 (a credit of 23 dollars and 78 cents), enter – 23.78 in this field. Include the minus sign in front of the amount.

-

Click Add.

-

Check the Bal Method field below the customer name, if the balance method is O (for Open Item), then you must apply this invoice to the unapplied credits or payments that make up the credit balance. Do this in Received on Account (ROA) as you normally would.

If the Bal Method field is B (for Balance Forward), you are done writing-off the transaction, you do not have to apply the invoice.

How General Ledger is updated

If you adjust a credit balance using the procedure described in section 1, then General Ledger is updated with a credit to the Cash account and a debit to the Accounts Receivable account.

|

|

DEBIT |

CREDIT |

|

CASH |

|

23.78 |

|

ACCOUNTS |

23.78 |

|