Entering Debit or Credit Memos

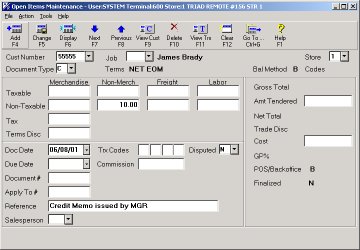

Field definitions for entering Debit or Credit Memos:

Document Type

There are three possible document types that can be entered in Open Item Maintenance (MOI). They are:

-

Invoice— Normally created at POS, when a sale is charged to a customer account. Invoices can also be added in Open Item Maintenance (MOI).

-

Credit— Normally created at POS, when a credit memo is charged to a customer account. Credits can also be added in Open Item Maintenance (MOI).

-

Adjustment— Created in Open Item Maintenance (MOI) only. An adjustment can be for a positive or negative amount (debit or credit).

![]()

-

Open Item Maintenance is normally used to enter beginning balances. After that, customer transactions (invoices and credits) are normally entered through POS.

-

Transactions entered through Open Item Maintenance will affect Accounts Receivable and Sales, but do not update the Inventory files. If you pass-off to General Ledger, the default Sales account (as specified in MCT) will be updated.

1

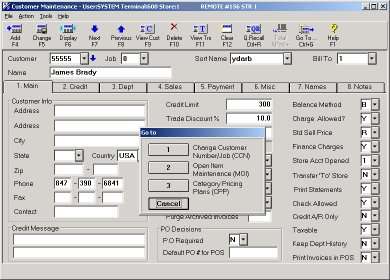

Access Open Item Maintenance

-

From the Eagle Browser, click Accounts Receivable, then click Customer Maintenance.

-

Enter the customer number.

-

Click Go To.

-

Select Open Item Maintenance.