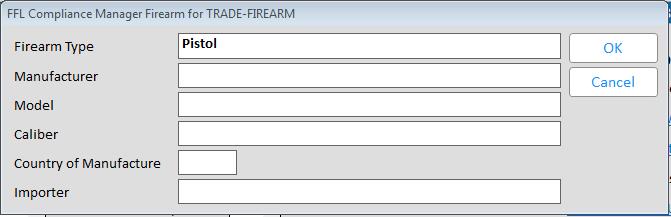

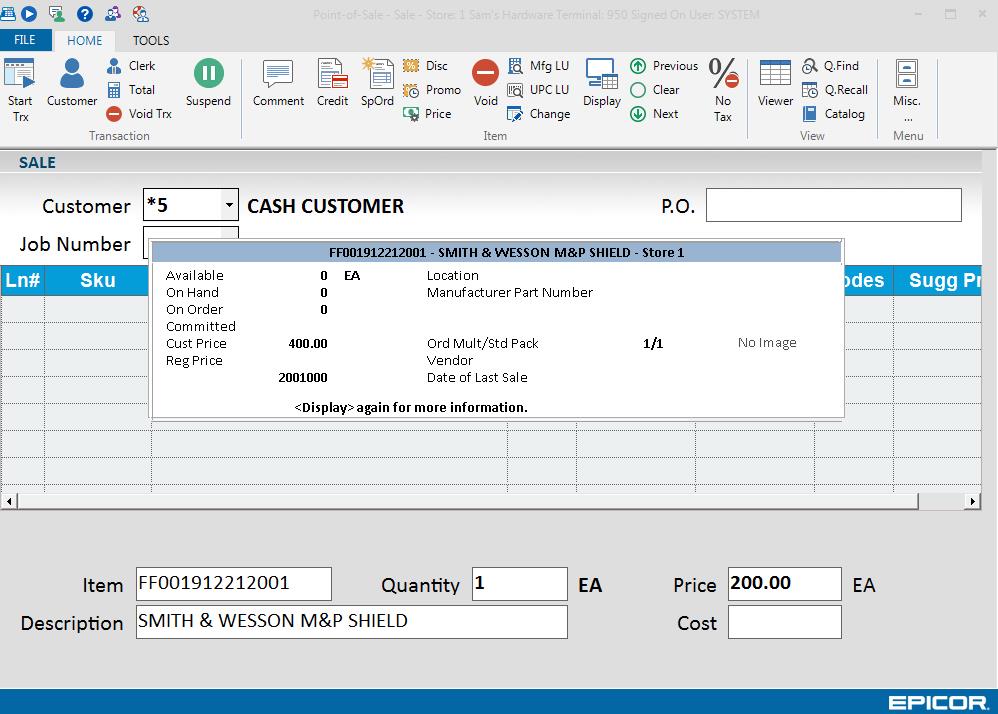

When the customer brings in a used firearm to trade-in on the purchase of a new firearm, the clerk will start a sale (or Order, or Special Order, or Layaway) for the customer/seller. The clerk will type in the firearm template SKU TRADE-IN-GUN and press <Credit> or post it on a Credit Memo.

To accept a trade-in of a firearm in POS, perform the following steps:

Select R for the Return Type. Select a Return Reason if prompted. Press Enter. Note: Do NOT select D or E for a trade-in.

At the bottom of screen the following text displays: ‘Enter a price for this item’. Press the Enter key. The Add SKU dialog opens.

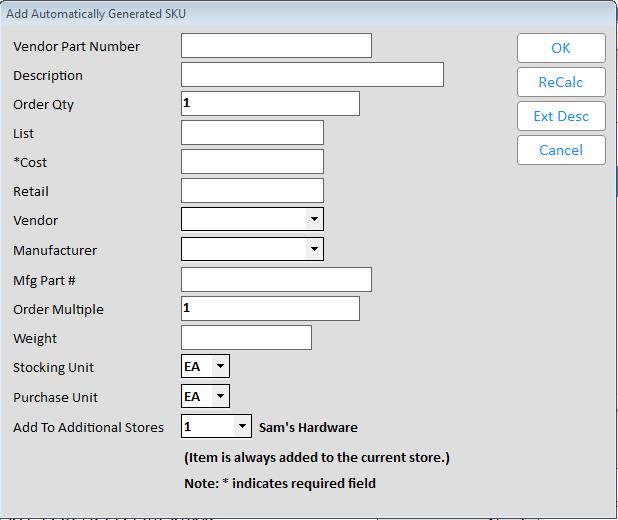

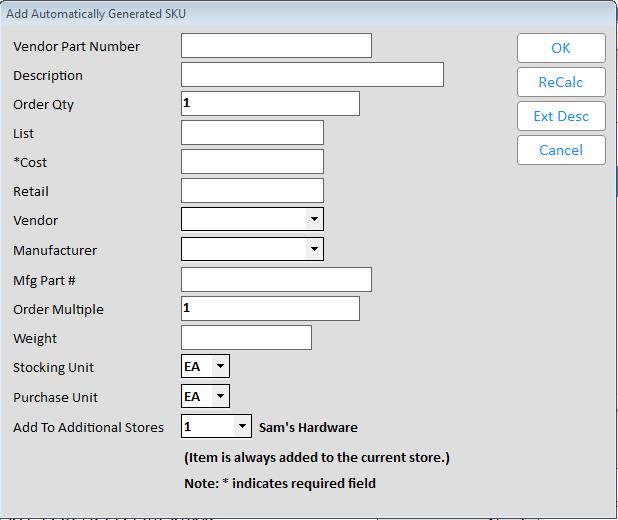

Leave Vendor Part Number blank, fill in the Description, enter 1 in the Order Qty, and enter the trade-in value in the Cost. Enter a price for the future resale of this used firearm in the Retail field, or leave it blank to have the system calculate Retail based on Des GP% from the trade-in template SKU and the Cost entered here.

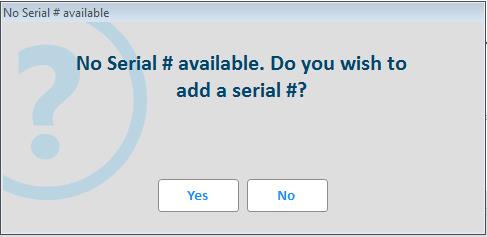

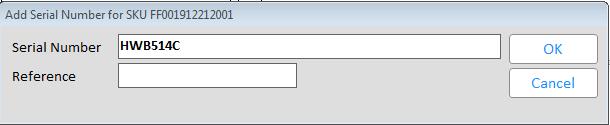

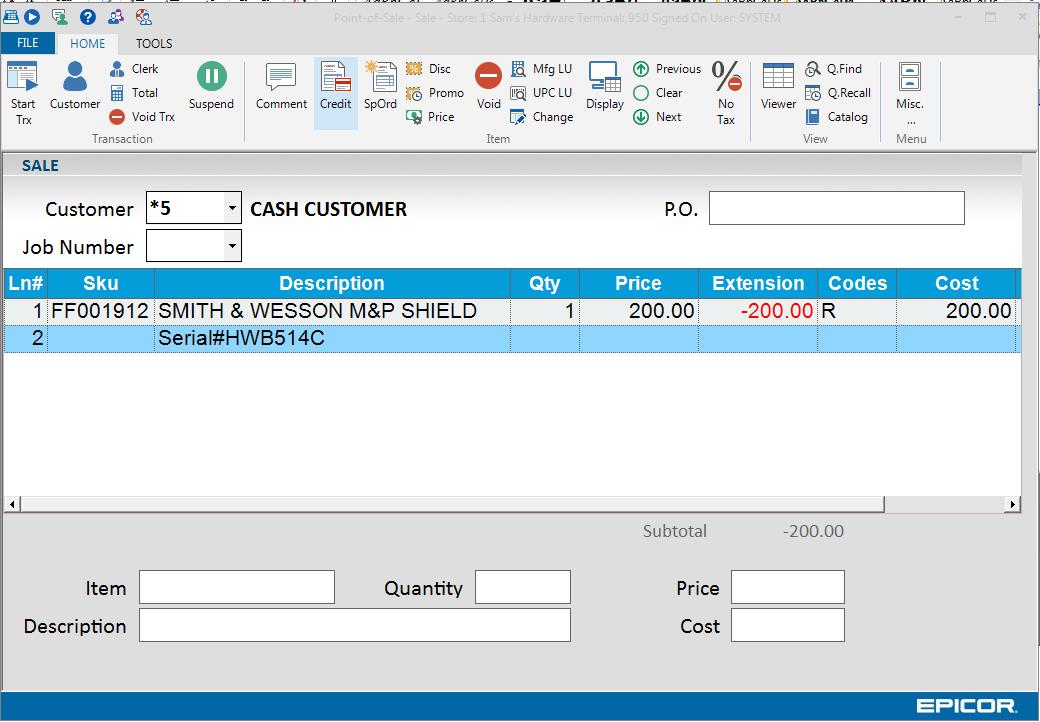

The serial # is posted into the body of the transaction as a ‘Serial #’ descriptor'. Notice

If the trade-in credit is to be used against a new purchase, the clerk will post the new firearm following firearm posting procedures.

If a new firearm is not being purchased the credit offsets any other purchases, or can be refunded to the seller in cash or other tender. Once the transaction completes the normal receipt or invoice will be printed.

FFLCM’s Acquisition queue will show a “Receipt: Vendor” for this traded in firearm. And if a new gun was purchased it will appear in the Disposition queue.

IMU – In IMU the trade-in firearm SKU will have QOH=1, Date of Last Receipt updated to today’s date, and the IMU History tab will show 1 in the Other Purchases (units) field. The Pricing tab’s Replacement and Average Cost will be the trade-in value and the Retail will be the value entered or calculated in the Add SKU dialog. The history tab will not be updated with the return dollars or unit in the sales fields since the trade-in is considered a purchase.

MDE – the department in option 1762 “Department used to track purchase of Trade-In” will have the Purchases at Retail and Cost updated with the trade-in value.

RDI will report the trade-in value under the department in option 1762.

RDS will report the dollars returned out of the cash drawer, but will also report the return dollars under the department from option 1762 to identify the cash out from trade-ins.

Since

returns are not departmental specific by account but rather only by subaccount,

a special subaccount for trade-in returns can be created in GL and assigned

to the POS subaccount for the department in option 1762 to have trade-in

returns post into their own subaccount of returns.

Since

returns are not departmental specific by account but rather only by subaccount,

a special subaccount for trade-in returns can be created in GL and assigned

to the POS subaccount for the department in option 1762 to have trade-in

returns post into their own subaccount of returns.

4.