This Dynamic Promotion (DP) allows customers to get their highest priced item free or at a discount. No Item List is needed.

Examples:

$10 off a single item over $50

20% off highest priced item

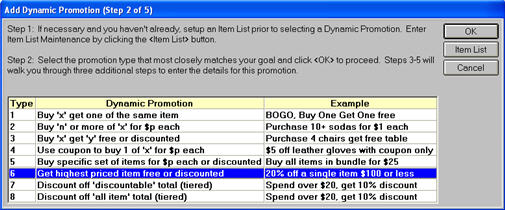

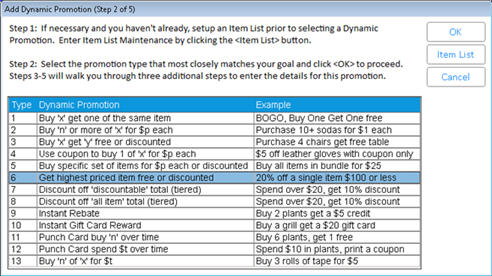

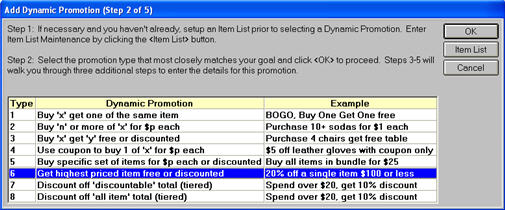

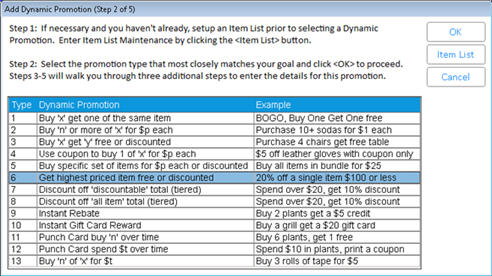

In the Maintain Dynamic Promotions viewer, select Add. Then select 6 “Get highest priced item free or discounted,” and click OK.

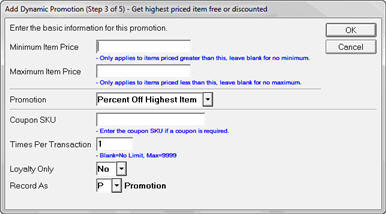

Enter the basic information for the promotion:

Minimum Item Price – Enter a minimum price for an item to qualify for a promotion if you wish. Whether you enter a minimum or leave it blank may depend upon the discount you are offering. You may not want to give $5 off a $5 item, for instance.

Maximum Item Price – Enter a maximum price for an item to qualify for a promotion if you wish. Again, consider the promotion you are offering. If you’re offering the highest priced item free, you may want to limit the price of the item that qualifies.

Promotion – Choose the type of promotion you will offer: Percent Off Highest Item, Amount Off Highest Item, or Free

Coupon SKU – Coupons are optional in this type of Dynamic Promotion. If you are requiring a coupon, enter the SKU here. If you enter a coupon SKU, the system will not give the free or discounted price unless the coupon has been scanned.

Times per Transaction – Enter the number of times this promotion is allowed on a transaction. The default is 1; entering a higher number will result in more than one item receiving the promotion.

Loyalty Only – Choose Yes to limit the Dynamic Promotion to Loyalty Customers. Selecting No makes the promotion available to all customers.

Record As – Choose how you would like the sale recorded: Promotion, Markdown, or Regular Sale. (Mark Down is only available when MSY ID# 9384 = Y.)

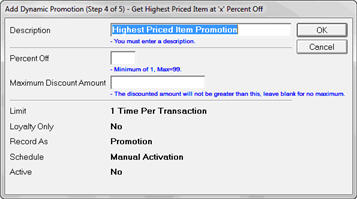

Set the parameters for this Dynamic Promotion.

Description – This appears in the Maintain Dynamic Promotions Viewer; customers will not see this name. Use the default or enter a new description.

Percent Off/Amount Off – The name for this box varies depending upon the type of Promotion you selected in the previous step. Enter the promotional pricing here. Note: If you selected Free for the Promotion, this field will not appear.

Maximum Discount Amount – Enter the maximum discount allowed per item. Note: This box doesn’t appear when the promotion is for “amount off highest item.” It does appear in a “highest item free” promotion to allow you to limit the price of the free item.

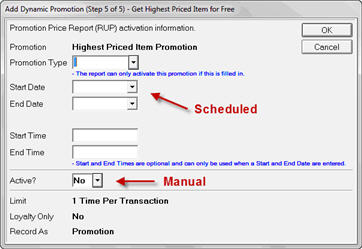

Activate the Dynamic Promotion by scheduling it with the Promotion Price Report (RUP) or manually activating it. Click OK to complete the Dynamic Promotion.

To schedule the activation/deactivation of a promotion using the Update Promotion Price Report (RUP), you must:

Enter the Promotion Type

Enter a Start Date and/or End Date

and/or

Enter a Start Time and/or End Time

To manually activate the Dynamic Promotion, select Yes for Active?.

You do not have to schedule or activate the promotion immediately. You can click OK without entering any information on this screen and the promotion is added to the Maintain Dynamic Promotions Viewer. Later, use the Schedule icon in the Maintain Dynamic Promotions Viewer to schedule the activation through the Update Promotion Price Report (RUP) or to manually activate/deactivate the promotion.

Whenever a credit sku is used for the discount, the involved items (which post with their normal selling price) will have a Dynamic Promotion Return Price calculated and stored in QuickRecall. If the item is returned and is validated to the original sale, the Dynamic Promotion Return Price from QuickRecall is the amount the customer will be refunded.

The return price from #2 above prints on the customer’s receipt as the ‘Return Value’ when option 9807 “Dynamic Promotions - print Return Value on receipts and enhanced forms” is Yes. This return price displays in the Dynamic Promotion Return Price column in QuickRecall, and it will be used when option 9528 “Returns Validation - use Return Price for Dynamic Promotions” is Yes and the return is validated to the original purchase.

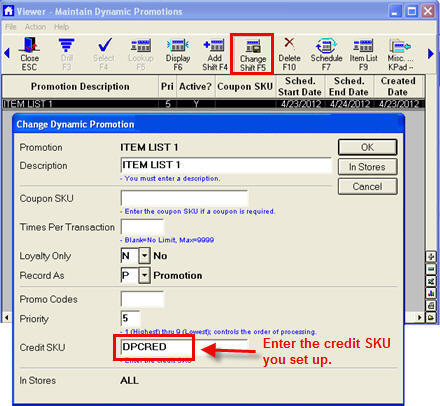

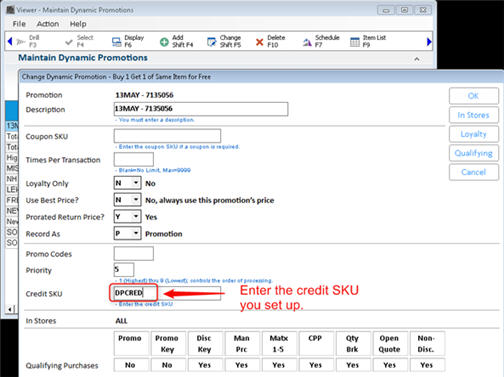

If your state requires tax to be collected on the regular price (rather than on the discounted price) when a promotion is sponsored by the manufacturer or supplier, set up a credit SKU to use with this DP. Then, after adding the DP, click Change, and in the Credit SKU field, enter the Credit SKU so that tax will be calculated based on the pre-discount amount.