This topic provides an example of the End of Day Sales Totals (RDS) and definitions of the fields on the report. For more information about RDS and procedure steps for running the report, click here to go to the online help topic. This report is available from both the Eagle Browser and Network Access.

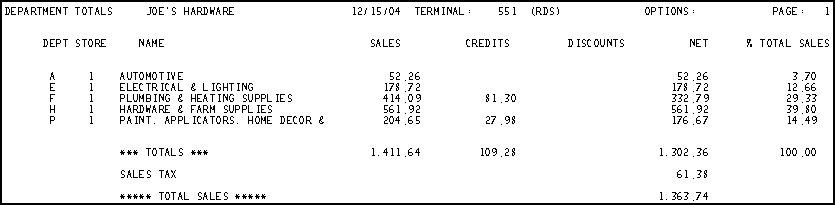

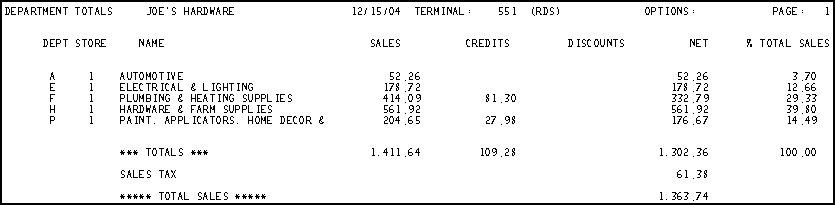

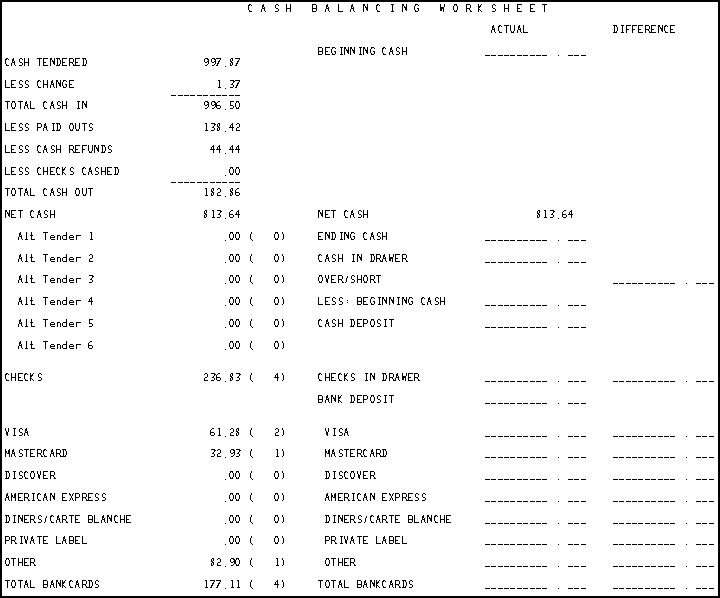

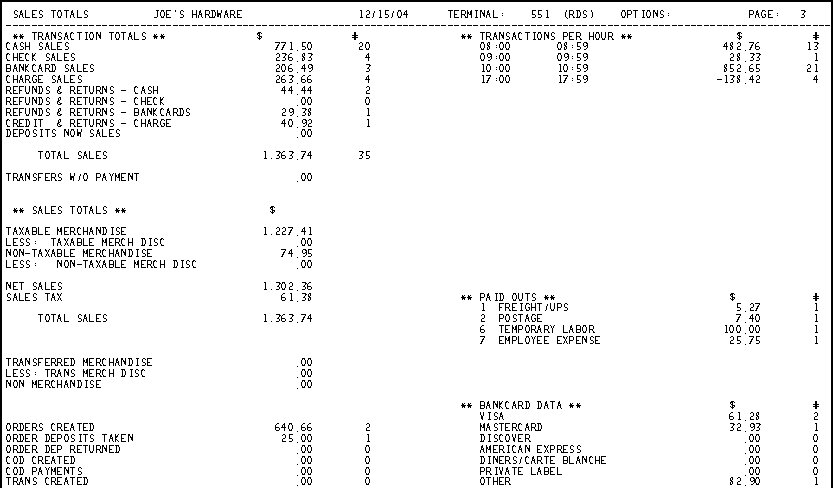

The following is an example of the report. Click a field in the report to take you to the field definition. The RDS report consists of three sections: 1) Department Totals, 2) Cash Balancing Worksheet, and 3) Sales Totals.

The following is a list in alphabetical order of the fields on the RDS report, grouped by the three sections of the report: 1) Department Totals, 2) Cash Balancing Worksheet, and 3) Sales Totals.

Field Definitions for the Department Totals Section

% Total Sales— Percentage of sales that the department contributed to the Store total. Does not include credits or discounts.

Alt Tender— The system calculated totals for transactions that included alternate tender amounts.

Credits— Total credits processed for the department. This amount does include line item credits within invoices.

Discounts— Total discounts processed for the department. Discounts include the following: Disc key, Promo key, trade discounts (manual and automatic), and immediate terms discounts. The following discounts are not included: deferred terms discounts, quantity break pricing, slash (multiples) pricing, system promo pricing, S pricing, open quote pricing, matrix pricing, and manual price overrides.

Name— The name of the department from the department record, Department Maintenance (MDE).

Net— Net sales for the department. Calculated as: (Sales – Credits) – Discounts

Options— The option codes used when running this report. For a definition of each Option, click here to go to the help topic.

Sales— Total sales amount for the department. This amount does include line item sales within credit memos.

Sales Tax— Net amount of sales tax calculated. If you have not entered any back office transactions, then this amount should match the Net Change to Accounts in the Tax column on the Daily Journal Report (RDJ).

Total Sales— The total sales processed at POS. Calculated as Totals (Net column) plus Sales Tax.

Totals— The sum of each column (Sales, Credits, Discounts, Net % Total Sales) for all departments on the report.

Field Definitions for the Cash Balancing Worksheet Section

Actual— Use this column near the middle of the worksheet to write the actual amounts in the cash drawer for each category (cash, checks, etc.). Then do the calculations to determine the amounts (for cash in drawer, deposits, etc.).

Authorization— Use this column on the right side of the worksheet to initial the counted amounts.

Bank Deposit— Use this field to enter the amount to be deposited in the bank. Usually this is the sum of the amount in the Cash Deposit field and the amount in the Checks in Drawer field.

Bankcard Deposit— Use this field to enter the bankcard deposit amount. Usually this is the amount in the Total Bankcards field minus the amount in the Service Charge field.

Bankcards (Visa, Mastercard, etc.)— The system calculates and prints the total amount for each bankcard type. In parentheses next to the amount is the number of transactions for each type. In the Actual column there are blank lines to enter the actual amount in the drawer for each bankcard type. Then use the Differences column to note any differences in the actual and counted amounts.

Beginning Cash— Use this field to enter the amount of a cash in the drawer before completing any POS transactions. Check the worksheet you are using, depending on the options used when running the report, the amount you enter in this field is for a terminal, clerk, or store.

Cash Deposit— Use this field to enter the cash amount to be deposited in the bank.

Cash in Drawer— After counting the amount of cash in the drawer, write the amount in this field.

Cash Tendered— This is the sum of the amounts entered into the Cash field at the end of a POS transaction. This is the amount received by the clerk before giving back change due. Cash can be tendered for the following types of transactions: cash sales (and cash returns), cash payment for an ROA, cash deposit (and cash deposits returned), cash COD payments (and cash COD returns).

Checks— The system calculates and prints the total amount of checks taken during POS transactions (less any checks returned). In parentheses next to the amount is the number of checks. In the Actual column there is a blank line to enter the actual amount of checks in the drawer. Then use the differences column to note any differences in the actual and counted amounts. Note that if change was given on a transaction tendered by check, the full amount of the check is included in the Checks field.

Difference— Use the blank lines in the Difference column to note any differences (over or short) in the actual and counted amounts.

Ending Cash— Add the Beginning Cash amount to the Net Cash amount and enter the total in this field.

Less Beginning Cash— Enter the amount of Beginning Cash (from the field at the top of the worksheet) in this field. This is the amount that will remain in the drawer for the next day.

Less Cash Refunds— Total amount of cash refunded to customers for returned merchandise.

Less Change— Total amount of change returned to customers.

Less Checks Cashed— Total amount of checks cashed using the No Sale Menu, option 4-Cash a check.

Less Paid Outs— Total amount taken from the cash drawer using the No Sale Menu, option 8-Enter paid out.

Net Cash— The amount the system calculated for the net amount of cash in the drawer based on transactions.

Options— The option codes used when running this report. For a definition of each Option, click here to go to the help topic.

Over/Short— Use the blank field in the Differences column to enter any difference between the amounts you entered in the Ending Cash field and the Cash in Drawer field.

Service Charge— Use the blank field to enter any fees charged for processing bankcards.

Total Bankcards— The total amount of bankcard transactions at POS (including sales, returns, ROAs, deposits). In parentheses next to the amount is the number of bankcards. In the Actual column there is a blank line to enter the actual total amount of bankcards in the drawer. Then use the differences column to note any differences in the actual and counted amounts.

Total Cash In— The system calculates this amount as the Cash Tendered minus the Less Change field.

Total Cash Out— The system calculates this amount as the sum of the "Less" fields for Paid Outs, Cash Returns, and Checks Cashed.

Field Definitions for the Sales Totals Section

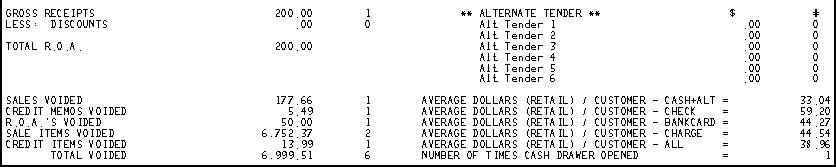

Alternate Tender— A list by alternate tender type of the total dollar amount, and number of times for each type.

Average Dollars (Retail) / Customer— The averages are calculated from the amounts in the Transactions Totals section. For each transaction type (cash + alt, check, etc.) the amounts in the $ column (Sales - Returns) are divided by the sum of the numbers in the # column.

Bankcard Data— A list by bankcard type of the total dollar amount, and number of times for each type.

COD Created— Total amount of all CODs created. The amount included is the total of the COD the first time it was saved at POS. If the COD is later recalled and changed the same day it was created, the changed amount is not calculated in this field.

COD Payments— Payments for invoiced COD transactions. The dollar amount is the transaction total less any deposits that were taken prior to invoicing. Any prior deposit amounts are included in the Deposits Now Sales field.

Credit Items Voided— Total amount of all credit line items voided.

Credit Memos Voided— Total amount of credit memos voided (Void Transaction).

Gross Receipts— Total ROA amount on ROAs taken at POS, includes discounts.

Less Discounts— Total amount of terms discounts for ROAs taken at POS.

Less Trans Merch Disc— Total discounts given on Transfer transactions.

Non Merchandise— Total amount of all Special Record items. These are SKUs in Inventory Maintenance (IMU) with an F (freight), L (labor), or M (miscellaneous) in the Special Record Field.

Number of Times Cash Drawer Opened— Total number of times the cash drawer was opened using the No Sale Menu option 1-Open cash drawer.

Options— The option codes used when running this report. For a definition of each Option, click here to go to the help topic.

Order Dep Returned— Total amount of all deposits refunded to the customer.

Order Deposits Taken— Total amount of all deposits taken (on orders, special orders, CODs).

Order Created— Total amount of orders, special orders, and CODs created. The amount included is the total of the transaction the first time it was saved at POS. If the transaction is later recalled and changed the same day it was created, the changed amount is not calculated in this field.

Paid Outs— A list of the reason number, description, total dollar amount, and number of times for each paid out category. The system does not include this amount when passing of to General Ledger from the Daily Journal Report (RDJ).

R.O.A's Voided— Total amount of ROA transactions that were voided at POS.

Sale Items Voided— Total of line items voided during sale transactions.

Sales Totals— This section includes the following fields:

Taxable Merchandise— Total amount of all taxable merchandise sales. This amount does not include sales tax.

Less Taxable Merch Disc— Total discounts given on taxable merchandise sales. Includes the following: Disc key, Promo key, trade discounts (manual and automatic), immediate terms discount. The following are not considered discounts: deferred terms discount, quantity break pricing, slash pricing (for example, 3 for $1.00), system promotion pricing, S pricing, open quote pricing, matrix pricing, manual price overrides.

Non-Taxable Merchandise— Total amount of all non-taxable merchandise sales.

Less Non-Taxable Merch Disc— Total discounts given on non-taxable merchandise sales. Includes the following: Disc key, Promo key, trade discounts (manual and automatic), immediate terms discount. The following are not considered discounts: deferred terms discount, quantity break pricing, slash pricing (for example, 3 for $1.00), system promotion pricing, S pricing, open quote pricing, matrix pricing, manual price overrides.

Net Sales— Total amount of sales before tax. This amount matches the Net Sales field on the Daily Inventory Update Report (RDI).

Sales Tax— Total amount of sales tax.

Total Sales— The sum of the $ column in the Sales Totals section.

Sales Voided— Total amount of sale transactions voided (Void Transaction).

Total R.O.A.— Net amount of ROAs taken at POS.

Total Voided— Total amount of all voids.

Trans Created— Total amount of transfer transactions created at POS. The amount included is the total of the transaction the first time it was saved at POS. If the transaction is later recalled and changed the same day it was created, the changed amount is not calculated in this field.

Transactions Per Hour— The total dollars and number of transactions listed by hour.

Transaction Totals— This section includes the following fields:

Cash Sales— Total amount of cash sales including prepaid charges.

Check Sales— Total amount of sales paid by check.

Bankcard Sales— Total amount paid by credit cards.

Charge Sales— Total amount of sales charged to customer accounts.

Refunds & Returns - Cash— Total amount of returns that were refunded as cash.

Refunds & Returns - Check— Total amount of returns that were refunded as check.

Refunds & Returns - Bankcards— Total amount of returns credited to bankcards.

Credit & Returns - Charge— Total amount of charge customer credit transactions.

Deposits Now Sales— Total amount of prior deposits that were included on an invoiced transaction.

Total Sales— The sum of the $ column in the Transaction Totals section.

Transferred Merchandise— Total amount of merchandise transferred to other stores.

Transfers w/o Payment— Transfer transactions that were completed without payment. The Charge Allowed field is T in the customer record (Customer Maintenance - MCR).