Both a provincial tax (PST) and a federal tax (GST) can be assessed on a single transaction if you are in Canada. Use the following procedure to set up a given tax code (the composite code) which is made up of multiple tax codes (the components). In Accounts Receivable and POS, the system will recognize composite tax codes, and calculate tax according to the rules of its components.

From the Eagle Browser Launch bar, type MTX, and press Enter. The Maintain Tax Codes window displays.

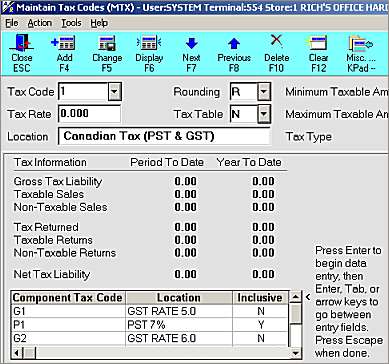

Add the Composite tax code by doing the following:

In the Tax Code field, enter a short identifier (up to three digits) for this tax code.

In the Location field, enter "Canadian Tax (PST & GST)". Since this will be used as the 'Composite' code, you do not need to enter any of the other fields on this screen.

Press Add.

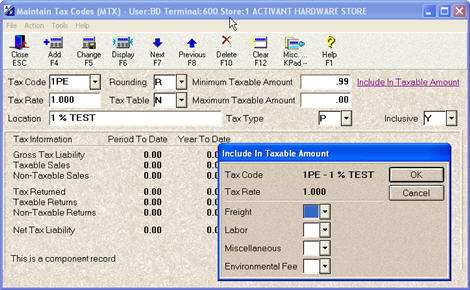

Add the GST tax codes by doing the following:

In the Tax Code field, enter a short identifier (up to three digits) for this tax code.

In the Tax Rate field, enter the tax rate.

In the Location field, enter a description for this GST tax rate, such as "GST- Rate 7.0".

In the Tax Type field, select G.

Press Add.

Repeat this process for other GST rates.

![]()

Be sure to set up a GST tax code that is GST EXEMPT as well as a GST tax code with a tax rate of 0.00, so that they can be tracked separately.

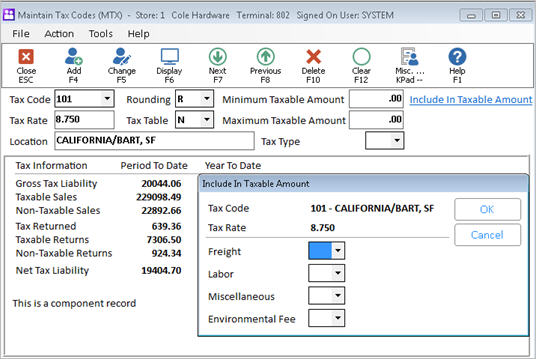

Add the PST tax code by doing the following:

In the Tax Code field, enter a short identifier (up to three digits) for this tax code.

In the Tax Rate field, enter the tax rate.

In the Location field, enter "PROVINCIAL SALES TAX" or something similar.

In the Tax Type field, select P.

If PST tax is inclusive in your province or state, enter a Y in the Inclusive field. Otherwise, leave that field set to N.

Press Add.

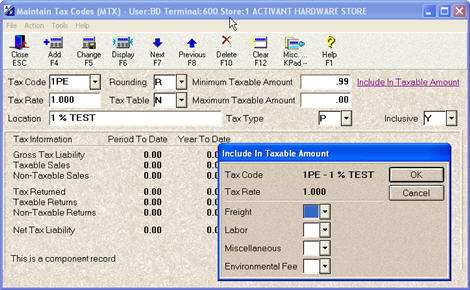

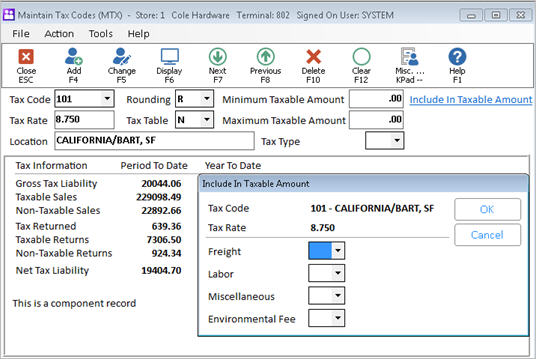

Tie your GST and PST tax codes to your composite tax code, as follows:

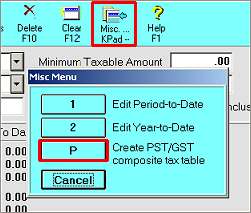

Click Misc, and then click "Create PST/GST composite tax table."

Press Enter so you can begin entering component tax codes.

Enter the component tax codes in the left column. You can enter up to six component tax codes.

![]()

An 'Inclusive' tax code is only inclusive of the codes ABOVE it. Therefore, the order that you add components is very important if you are using an inclusive tax code. In the following example, the tax code P1 is inclusive of tax code G1 only, because G1 is listed above it. (note - you can only have one 'inclusive' component in any given composite tax code.)

Press <Escape> when you're done entering the component tax codes.

Click  .

.

![]()

POS allows up to 15 line item or component taxes in a single transaction. For example, if the header tax code is a composite tax code, made up of 6 component tax codes, and there are also items with their own line-item tax codes, you could have nine different line-item tax codes before reaching the limit of 15 (6 components + 9 line-item codes).

Line-item and component tax amounts track ’Non-taxable’ sales at the line-item level. This allows you to assign tax codes to non-taxable items so you can track non-taxable sales for certain merchandise types. For example, if you want to track non-taxable sales such as fishing licenses, you can assign a unique line-item tax code to the item.