Using the Bank Reconciliation Viewer

This topic describes the various functions of the Bank Reconciliation

Viewer. Accounts Payable and Payroll checks automatically pass to the

Bank Reconciliation Viewer whenever you run their respective reports to

post checks. You can also add transactions to the viewer manually, so

that the transactions you reconcile in the viewer match the transactions

listed on your bank statement.

This procedure assumes that option 8963 "Bank Reconciliation Enabled"

is set to Yes in Options Configuration, and that you set security bit

748 "Access Bank Reconciliation Viewer” set to Yes in Security Maintenance

for users whom you want to have access to this viewer. You may also want

to set option 9031 "Create G/L Transactions for Cash Drawer Short/Over"

to Yes.

This procedure includes how to:

For

a definition of the fields in the Bank Reconciliation Viewer, click here.

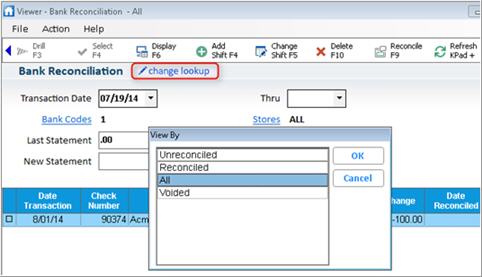

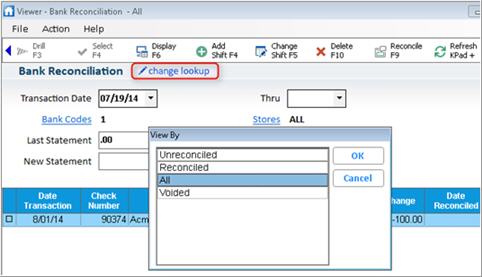

Displaying Transactions

- Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

- The viewer defaults to displaying all transactions.

To look up a subset of transactions, click Look Up, and select one

of the lookup methods: unreconciled, reconciled, all, or voided.

- In the From and Thru fields, select the range

of dates of the transactions you want to view.

- (Optional)

Click the Bank Codes hyperlink, select a bank code(s), and click OK.

You can also leave this field set to the default of ALL bank codes.

- (Optional)

Click the Stores hyperlink, select a store(s), and click OK. You can

also leave this field set to the default of ALL stores.

- Click Refresh to

populate the grid based on your previous selections.

Adding Transactions Manually

To make the Viewer match your bank statement, you can add other transactions

to the viewer manually.

- Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

- Click Add. The Add Bank Reconciliation Transaction

dialog displays.

- Fill in the fields, based on the type of transaction

you want to add. If you are adding a negative amount, for transactions

such as a register adjustment, ATM withdrawal, etc., be sure to enter

a negative (-) sign before the number you enter in the Amount field.

- Click OK to post the transaction to the grid.

If you want to enter another transaction, repeat step 3. Otherwise,

click Cancel to exit the Add window.

Changing Transactions

- Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

- Highlight the transaction you want to change.

- Click Change, or double-click on the transaction.

The Change Bank Reconciliation Transaction dialog displays.

- Make your changes.

If

you are entering a Cash Out amount in the Amount field, be sure to use

a negative sign before the number.

- Click OK, and click OK again in the confirmation

dialog.

Copying Transactions

- Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

- Highlight the transaction you want to copy.

- Click Misc, and select Copy Bank Reconciliation Transaction.

The Copy Bank Reconciliation Transaction dialog displays.

- If desired, make any changes to the information

from the original transaction.

- Click OK. Then click OK again in the confirmation

dialog. The transaction is copied, including the fields you modified

(if any).

Deleting Transactions

- Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

- Place a checkmark next to the transaction(s)

you want to delete.

- Click Delete, then click OK in the confirmation

dialog.

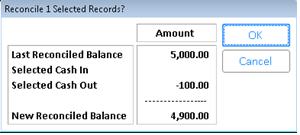

Reconciling Transactions

Note: Epicor strongly recommends you perform reconciliation on one bank

at a time, because the new reconciled balance is only updated in the bank

record if a single bank is selected. If multiple banks are selected, the

new balance cannot be determined for each bank, thus requiring you to

manually update bank balances.

- Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

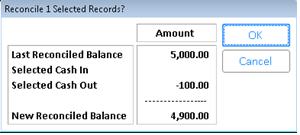

- (Optional)

In the Last Stmt field, enter the ending balance amount from your

last reconciliation. The system uses this figure to calculate a reconciled

balance based on the following formula: Last Reconciled (statement)

Balance + Cash In - Cash Out.

- Place a checkmark next to the transactions you

want to reconcile. Note the following:

- The “Selected” field displays the total value

of the selected rows.

- The amount in the “Variance” field

is based on the following calculation: Last Stmt + selected transactions–

New Stmt

- The fields in the header area of the viewer are

disabled to keep the “Variance” amount correct. If you change the

lookup method, de-select records in the grid, refresh the grid, or

reconcile the items in the grid (in the next step), the header fields

are re-enabled.

- Click Reconcile.

If you entered an amount

in the Last Stmt field, a summary displays of Last

Reconciled BalanceThe

ending balance from your last reconciliation that you entered in the Old

Statement field., Cash

InThe sum of all the debit

transactions you check-marked for reconciliation in the grid.,

Cash OutThe sum of all the credit transactions you check-marked

for reconciliation in the grid., and New

Reconciled BalanceLast

Reconciled Balance +Selected Cash In - Selected Cash Out..

- Select Yes in the dialog that displays, and

click OK in the confirmation dialog. This sets all the selected transactions

to "reconciled” and enters the current date in the Date Reconciled

field.

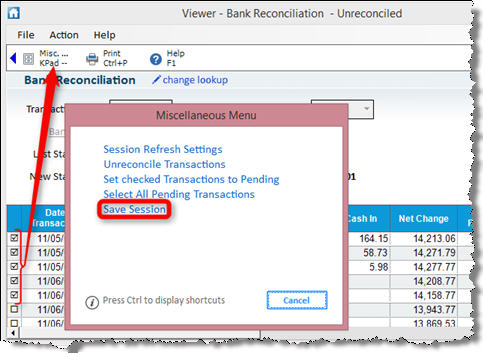

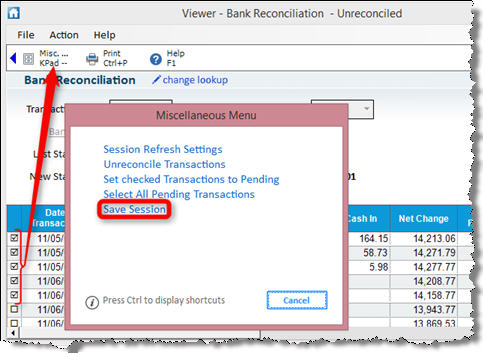

Saving a Reconciliation in Progress

If you need to leave the Bank Reconciliation viewer before completing

the reconciliation, you can save your work-in-process. Then upon re-opening

Bank Reconciliation and selecting the desired bank code and date range,

you can recall and apply that saved session and continue on with your

work to finish up the reconciliation to their bank statement.

- Click Misc, and select “Save Session.”

You are now safe to exit Bank Reconciliation;

your work-in-process for that session has been saved locally to the PC.

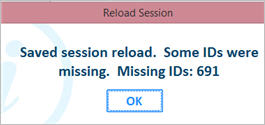

- To recall a saved session, after opening Bank

Reconciliation and selecting the correct bank code and date ranges,

click “Misc.” button and select “Reload Session.”

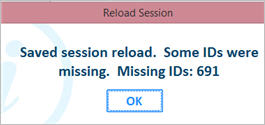

The session is saved locally on the PC that

selected to save a session. If in the time between saving a session and

reloading a session items have already been reconciled or deleted, when

you attempt to reload the saved entries, a dialog indicates that some

items could not be loaded and which ID's they were. Below is a sample

of this message.

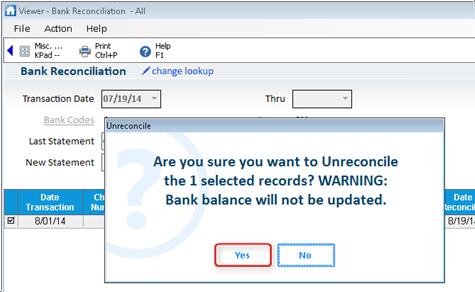

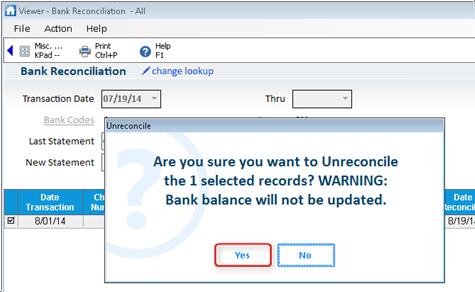

Un-Reconciling Transactions

Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

Display unreconciled transactions

by clicking Lookup, and selecting Reconciled. Then click OK

Place a checkmark next to

the transaction(s) you want to un-reconcile.

Click Misc, and select Unreconcile

Transactions. A warning message displays.

Click Yes. Then click OK

in the confirmation dialog.

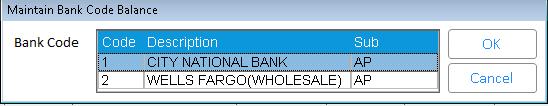

Manually Update Bank Balance

Use this feature only if you need to manually change

the last bank balance amount (for example, you performed reconciliation

for multiple banks at one time, thus requiring that you manually change

individual bank balances).

Display

the Bank Reconciliation ViewerFrom the Eagle Browser, type BRVIEW in the Launch

bar, and press Enter. (Alternatively, you can click Accounts Payable

Menu, Bank Reconciliation Viewer)..

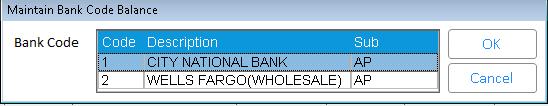

Click Misc, and select Maintain

Bank Balance. The Maintain Bank Code Balance dialog displays.

Select the bank code to

change, and click OK.

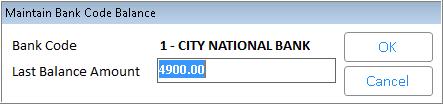

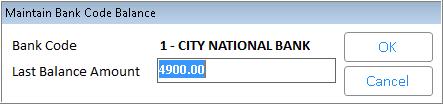

In the next dialog, enter

the last balance amount and click OK.

For

a definition of the fields in the Bank Reconciliation Viewer, click here.

![]()

![]()

![]()