This topic provides an example of the Daily Journal Report (RDJ) and definitions of the fields on the report. For more information about RDJ and procedure steps for running the report, click here to go to the online help topic. This report is available from both the Eagle Browser and Network Access.

The following is an example of the report. There are three sections to the report, page 1 is the detail information, page 2 is the cash summary, and page 3 is the financial account summary. Click a field in the report to take you to the field definition.

Page 1 detail information

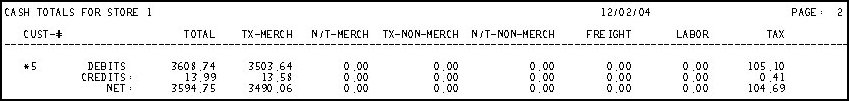

Page 2 cash summary

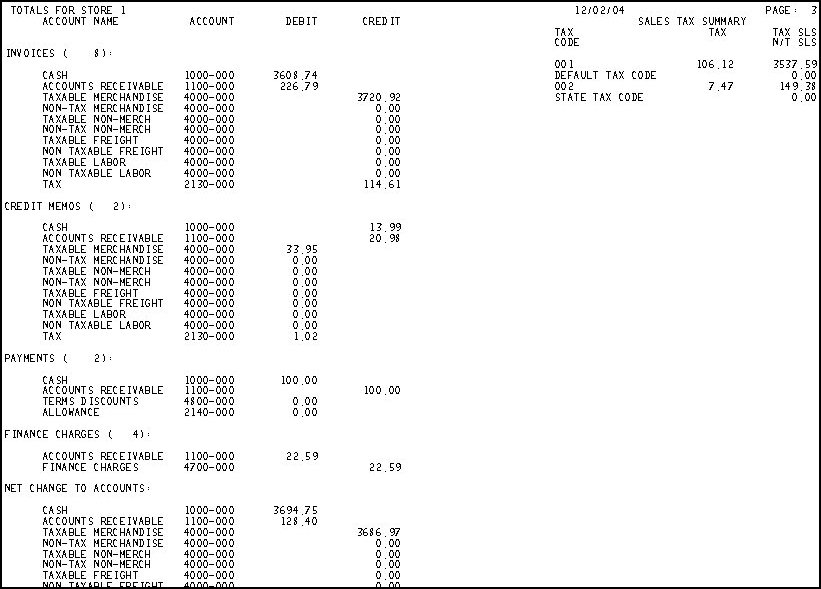

Page 3 financial account summary (note that this section of the report does not include links for the field definitions)

The following is a list in alphabetical order of the fields on the RDJ report.

Account Name— The name of the account from the customer record in Customer Maintenance (MCR).

Allowance— The allowance amount entered for this transaction.

App To— The document number that the ROA payment was applied to.

Codes— Codes associated with the transaction. Codes can be manually assigned in ROA or MOI, or automatically assigned by POS. When located in the first position (of the four-position code field), the following codes are defined as follows:

D = Received a deposit amount as a Charge

O = Invoiced from an Order (with or without a deposit)

S = Mixed Transaction

C = Cash Transaction (cash tendered only)

G = Invoiced Special Order for which GPO generated a PO

K = Checks

B = Credit Card Tender

A = Charged to an account

Cust #— The customer number of the account.

Debits Credits Net— In the Totals section of the report:

Debits = This is the sum of all I type transactions for the customer number.

Credits = This is the sum of all C type transactions for the customer number.

Net = This is the sum of the debits and credits for the customer number.

Discount— The discount amount associated with this transaction.

Doc #— Document number, a unique number assigned to the document.

Doc Date— The date assigned to the document, usually this is the date the document was created.

Due Date— The date the transaction is due, based on the terms code of the customer.

GP%— Gross profit percent, calculated as Profit dollars divided by Sales dollars.

Job— The job number of the account.

Merch, Freight, Labor— A breakdown of the Total amount of this transaction.

Options— The option codes used when running this report. For a definition of each Option, click here to go to the help topic.

Payment Check #— Payment is the payment amount for an ROA. Check # is the check number entered when the ROA was posted.

Reference— Information that was entered when the transaction was added to the system in ROA or MOI.

Salespn— Salesperson. The salesperson code associated with this transaction.

Tax— The tax amount included on this transaction.

Tax Code— The tax code for the tax amount included on this transaction.

Total— The total dollar amount of this transaction.

T = The document type. A = Adjustment, C = Credit, F = Finance Charge, I = Invoice, P = Payment.

S = The Store in which the transaction was created.

B = A Y in this column indicates that this is a back office transaction, blank indicates that this is a POS transaction.