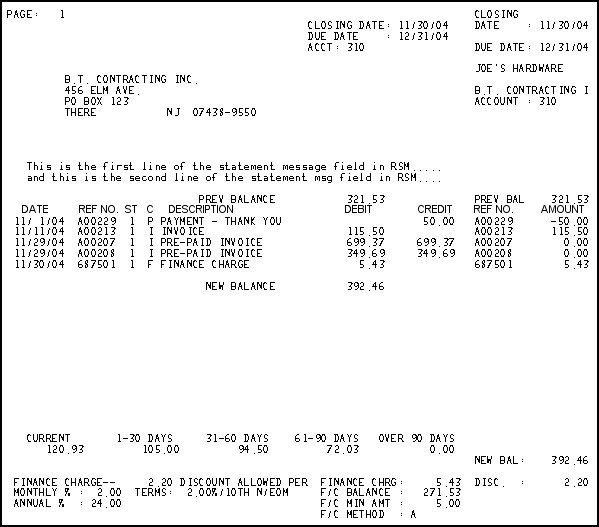

This topic provides an example of the A/R Statement Report (RSM) and definitions of the fields on the report. For more information about RSM and procedure steps for running the report, click here to go to the online help topic. This report is available from both the Eagle Browser and Network Access.

The following is an example of the report. Click a field in the report to take you to the field definition.

The following is a list in alphabetical order of the fields on the RSM report.

Acct— The customer number of the account.

Amount— Net transaction amount.

C— The document type code. A = Adjustment, B = Balance Forward, C = Credit Memo, F = Finance Charge, I = Invoice, P = Payment

Closing Date— The close date that applies to this statement.

CR Available— Revolving Charge accounts only. Credit Available. Amount credit limit exceeds new balance.

Credit— Amount credited to the customer account.

Credit Limit— Revolving Charge accounts only. Credit limit for this account from the customer record in Customer Maintenance (MCR).

Curr Period— Revolving Charge accounts only. Current Period. Total of transactions which occurred between the Start Date and Closing Date.

Current, 1-30, 31-60, 61-90, over 90— Balance Forward and Open Item accounts only. Aging buckets and their associated balances as calculated by the RSM report using the Closing Date.

Date— The document date of the transaction.

Debit— Amount debited to the customer account.

Discount Allowed / Disc— Balance Forward and Open Item accounts only. Terms discount amount based on the terms code for this account.

Due Date— Date payment is due according to the terms code for this account.

F/C Balance— Finance charge balance. The balance amount subject to finance charges.

F/C Method— Finance charge method. Method of calculating the balance subject to finance charge. The method is defined in Options Configuration, MCT - A/R Control File.

F/C Min Amt— Finance charge minimum amount. The amount is defined in Options Configuration, MCT - A/R Control File.

Finance Charge— The monthly and annual finance charge percents.

Finance Chrg— Finance charge. The total dollar amount of F-type documents with document dates between the Start and Closing dates of this RSM report.

Minimum Due— Revolving Charge accounts only. Calculated as follows: Minimum amount calculated by the RAG report + any Past Due Min amount + any amount by which the running balance exceeds the credit limit.

New Balance— The total of all transactions dated on or before the closing date on this RSM report.

Past Due Min— Revolving Charge accounts only. Past Due Minimum. Any previously billed minimum amount due which remains unpaid.

Prev Balance— Previous balance for this account.

Reference No.— The document number of the transaction.

St— Store. The Store in which the transaction was entered.

Terms— Balance Forward and Open Item accounts only. The description of the terms code assigned to this account.